Investors Await U.S. Employment Report

World stock markets continued to show weakness on Friday as investors waited with bated breath for U.S. employment data, which could either deepen the bond market sell-off or ease the tension a bit. Meanwhile, the dollar is holding steady near a two-year high.

U.S. Exchanges in the Red

Nasdaq and S&P 500 futures fell 0.3%, reflecting tensions among market participants. Wall Street remained closed yesterday for the funeral of former US President Jimmy Carter. Meanwhile, European STOXX 50 futures and the UK FTSE were steady, showing no significant changes.

Key Moment of the Day: Employment Data

All eyes are on the US non-farm payrolls report, due at 8:30 a.m. ET (1:30 p.m. GMT). Analysts expect the number of jobs to increase by 160,000 in December, with the unemployment rate remaining at 4.2%.

However, the market is waiting not only for the numbers, but also for their impact on the economy. A stronger result could send 10-year Treasury yields soaring to their highest levels in 13 months. This, in turn, would strengthen the dollar.

Possible scenarios

According to ING, a result below 150,000 new jobs is needed to avoid further rise in Treasury yields. Any deviation from forecasts could set the markets on a new course, adding to turbulence.

Investors around the world are holding their breath, as today's outcome could set the mood for the coming weeks.

Employment report could be a turning point

Friday's key event, the publication of the US employment report, is causing a lot of speculation among investors and analysts. It is this data that could determine the future trajectory of the bond and currency markets, but experts note that the impact will only be noticeable in the event of a significant deviation from forecasts.

Experts warn: a surprise is needed

"The employment report, as always, plays a decisive role. But for it to have a noticeable impact, the results need to be significantly different from expectations," said Padraic Garvey, head of research for the Americas at ING.

The current situation suggests that markets have already priced in some of the potential outcome. "If the numbers are close to what we expected, there is a chance we could see some reaction to lower yields, which could introduce an element of vulnerability," Garvey added.

Fed in no rush to change rates

While investors ponder the impact of the new data, officials at the US Federal Reserve are showing caution. Philadelphia Fed President Patrick Harker said he believes rate cuts are inevitable in the future, but stressed there is no need to act hastily. Kansas City Fed President Jeff Schmid, on the other hand, took a harder line, arguing against any immediate rate move.

These statements reflect polarized views within the Fed, but markets have already adjusted their expectations. Traders are now forecasting a 43 basis point rate cut in 2025. However, adding to the nervousness are concerns that possible policies of President Donald Trump, including inflation programs, could spur a rise in long-term yields.

Bond yields rise, dollar strengthens

The current situation in the bond market shows a steady rise in yields. The benchmark yield on the 10-year US Treasury note rose by 1.5 basis points, reaching 4.6957%. Although this is slightly below the peak of 4.73% recorded earlier in the week, analysts are closely watching the critical level of 4.739%. If it is broken, the path to the 5% mark could open for the first time since 2007.

At the same time, the dollar is strengthening. The dollar index continues to rise for the sixth week in a row, reaching the level of 109.30. This is due to the rise in Treasury yields, which amounted to 9 basis points this week.

On the verge of change?

The current situation in the market reflects tense anticipation. Investors and analysts are bracing for the employment report to provide new momentum that will either reinforce current trends or force markets to adjust their expectations. Either way, Friday's numbers will be an important guide to future economic and investment decisions.

Pressure on the pound, rising commodity prices

Amid concerns about the health of the British economy, the pound continues to weaken, with UK government bond yields reaching multi-year highs. At the same time, commodity markets are showing gains, with oil and gold prices rising despite a general decline in Asian stock indices.

The British pound under pressure

The pound remains under pressure, having fallen 0.2% on Friday to $1.2278, its lowest since November 2023. The currency has lost 1.1% of its value over the week. Meanwhile, UK government bond yields, which reached a 16.5-year high, have retreated somewhat, but remain a concern.

Oil and gold markets in positive territory

Oil prices ended the week with positive dynamics. US West Texas Intermediate (WTI) crude rose 0.5% to $74.32 per barrel, giving it a weekly gain of 0.5%.

Gold prices were no less impressive: the metal rose 1.3% over the week, reaching $2,674.44 per ounce, which is close to its highest levels since December. These movements indicate growing investor interest in safe assets amid general uncertainty.

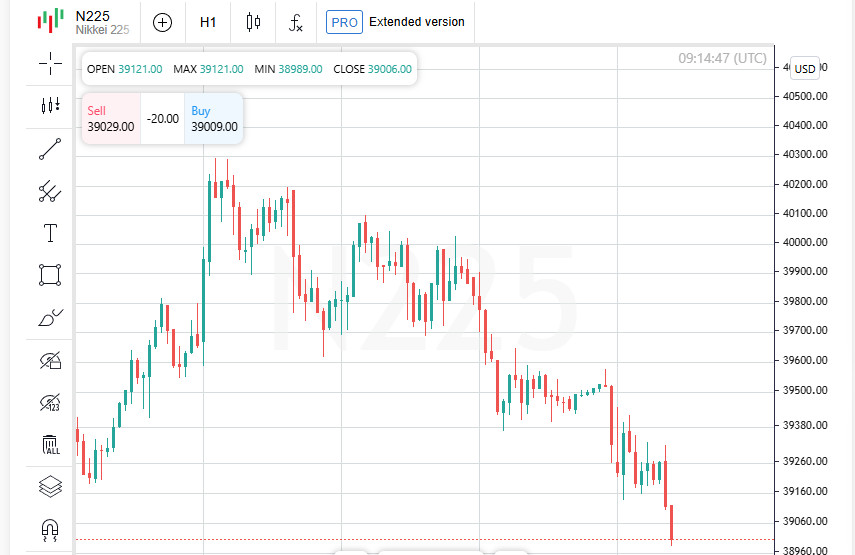

Asian markets fall

Asian stock markets ended the week on a minor note. Japan's Nikkei index lost 0.9% on Friday, bringing its weekly loss to 1.6%. The broad MSCI Asia-Pacific index of shares fell 0.5%, and its weekly loss amounted to 1.2%.

Chinese stock markets are also showing weakness, with the blue-chip CSI300 index falling 0.4% and Hong Kong's Hang Seng down 0.5%. The declines are linked to rising Chinese government bond yields after the country's central bank said it would temporarily suspend Treasury purchases due to a shortage.

Global sentiment remains tense

The overall picture in the markets is that investors are in a holding pattern. Amid weakness in stock markets and tensions over macroeconomic data, attention is focused on the upcoming US employment data. The report could set a new direction for bonds, currencies and commodities.

Global markets under pressure as investors await US employment report

Global stock and bond markets continue to show volatility amid expectations for key US employment data. US stock index futures are falling while bond yields are reaching new highs.

US markets pause, futures lose ground

Nasdaq and S&P 500 futures fell 0.3% after the US trading session was suspended for the funeral of former President Jimmy Carter. Meanwhile, Europe is expected to open flat, reflecting cautious investor sentiment.

Bond Market: Yields at multi-year highs

Tensions are rising in the bond market. The yield on the 10-year US Treasury note approached 4.739%, above which further gains could be triggered. The yield on the 30-year note rose 11 basis points in a week, reaching its highest in a year.

In the UK, the government debt situation is also causing concern, with bond yields soaring to their highest since 2008 amid doubts about the sustainability of the country's fiscal policy. Despite some relief, the market remains at risk.

Chinese Yuan Under Pressure, Bond Yields Rise

China's central bank has temporarily suspended purchases of Treasury bonds, citing a shortage. However, analysts believe the move is aimed at supporting the national currency, the yuan, which is facing pressure. As a result, Chinese bond yields also rose.

Employment Report: Key Indicator of the Week

All eyes are on the upcoming US employment report. Forecasts suggest a 160,000 job gain in December, with the unemployment rate remaining at 4.2%. However, the range of expectations is quite wide, from 120,000 to 200,000, which leaves room for surprises.

Adding to the uncertainty is the annual revision of household survey data, which could adjust unemployment statistics for recent months. This increases the likelihood that the report will have a stronger impact on the markets.

Global Markets Hold Their Breath

Markets are in a holding pattern as the jobs report could provide fresh impetus for U.S. bonds, the dollar and global stock indexes. Ahead of the data, investors and analysts are bracing for the possibility that a surprise result could be a catalyst for significant change.

Key Report Could Be a Game Changer

The upcoming US employment data could be a game changer for global markets. Strong numbers could accelerate the rise in US bond yields and strengthen the dollar, while weak numbers could raise new questions about the health of the global economy.

Breakthrough to 5%: Bond yields on the threshold of historic highs

If the report beats expectations, the yield on the 10-year Treasury note could exceed the important level of 4.739%, opening the way to a psychologically significant 5%. This figure has not been seen since 2007 and would be a powerful signal for bears, strengthening their position in the market.

Rising yields will put additional pressure on emerging markets, where the dollar is already playing a destructive role. The US currency, which is at a two-year high, continues to deepen financial problems in economies dependent on external debt.

High rates are a threat to stocks

The stock market could also react negatively. Higher bond yields and rising discount rates are calling into question lofty valuations, potentially triggering a sell-off. Investors facing rising risks can no longer count on stable stock growth without taking into account new macroeconomic realities.

Hope for balance: "Goldilocks" for the US economy

The ideal scenario for markets now is a moderately soft report. On the one hand, it should prevent further growth in bond yields and the dollar, on the other, it should not be so weak as to undermine faith in the resilience of the US economy.

However, the likelihood of a significant change in the Federal Reserve's course towards lower rates remains extremely low. The focus of the Fed and investors has shifted to the possible consequences of Donald Trump's economic policy in the coming months, where inflation risks may outweigh the need for easing.

The pound falls, the dollar strengthens

In the currency market, the dollar continues to show growth for the sixth week in a row. The British pound was the biggest loser, down 1% on the week to $1.2303, its lowest in more than a year. The pound's weakness reflects ongoing concerns about the UK's economic outlook and the impact of fiscal policy on its markets.

Markets are waiting. The results of the report will determine the next move for bonds, stocks and currencies. A successful balance between strong and weak data could reassure investors, while a significant swing in either direction risks triggering volatility.