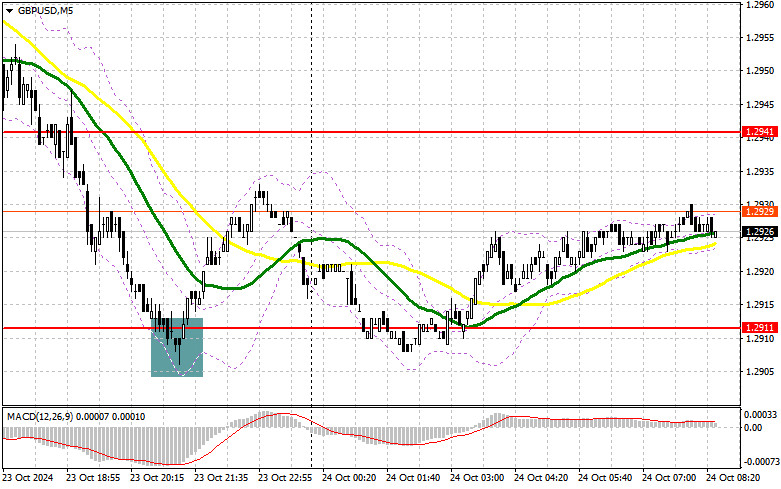

Yesterday, several suitable market entry points were formed. Let's look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the 1.2972 level and planned to use it for entry decisions. A breakout and retest of this range allowed for entering short positions, resulting in a drop of over 30 pips in the pair. In the second half of the day, buying on a false breakout near the significant support at 1.2911 brought about 20 pips of profit.

To open long positions on GBP/USD, the following is required:

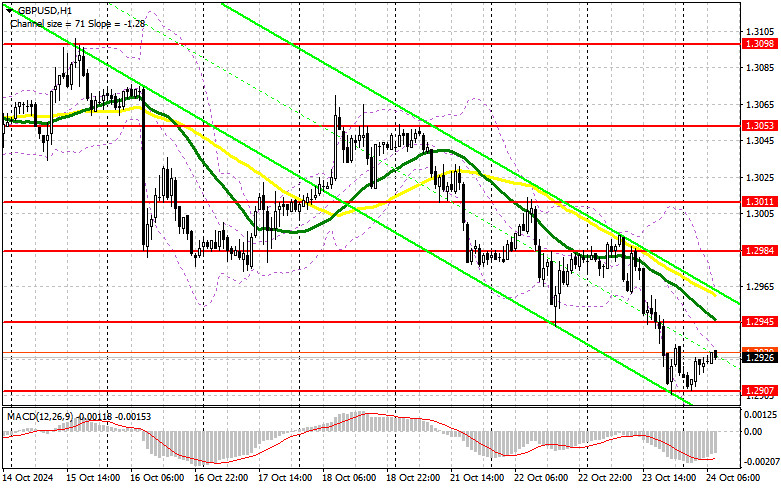

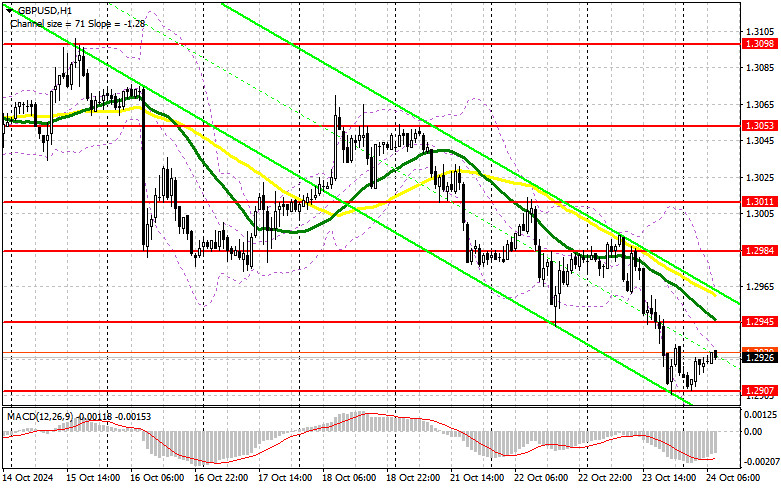

The pound is catching up with the euro regarding losses and is now trading around a new monthly low. The divergence in central bank policies speaks for itself. But today, there is potential for a decent recovery of the pair. It will all depend on the UK's Manufacturing PMI, Services PMI, and Composite PMI data. Strong figures indicating increased activity will support the British pound. In case of an adverse reaction to the data, only a false breakout at the new weekly low of 1.2907 will serve as a suitable entry point for long positions, aiming for a recovery of the pound and a retest of the 1.2945 resistance. A breakout and retest from above this range will increase the chances of the pair's recovery, leading to a stop-loss trigger for sellers and providing a suitable entry point for long positions, with a potential move up to 1.2984. Here, I expect more active sellers. The furthest target will be the 1.3011 area, where I plan to take profits. Testing this level would halt the bearish trend. In case of a decline in GBP/USD and a lack of activity from the bulls around 1.2907—toward which the market seems to be heading—the bears will strengthen their control over the market. This could push the pair to the next support at 1.2884, where I expect the bulls to become active. Only a false breakout at that level would be suitable for opening long positions. I plan to buy GBP/USD immediately on a bounce from the 1.2859 low, aiming for a 30-35 pip intraday correction.

To open short positions on GBP/USD, the following is required:

Sellers managed to renew the monthly low, maintaining the downward trend. As mentioned above, strong PMI data could cause problems, so I prefer to act as close as possible to the 1.2945 resistance. A false breakout at this level would confirm the presence of major market players betting on the pound's further decline. This would also provide a good entry point for short positions, with the prospect of another decline to the 1.2907 support—the monthly low. A breakout and retest from below this range would pressure buyers, triggering stop-losses and opening the way to 1.2884, further strengthening the bearish market. The furthest target would be the 1.2859 area, where I plan to take profits. In case of an upward move in GBP/USD and a lack of activity around 1.2945 in the first half of the day, where the moving averages—favoring sellers—are located, buyers may have a chance for an upward correction. I will delay selling until a false breakout at the 1.2984 level in this scenario. If there is no downward movement, I will sell GBP/USD immediately on a bounce from 1.3011, aiming for a downward correction of 30-35 pips.

Recommended Reading:

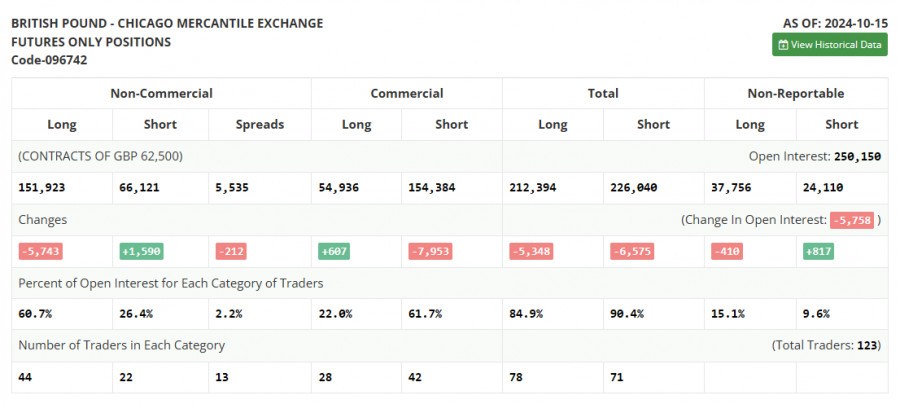

In the COT report (Commitment of Traders) for October 15, there was a decrease in long positions and an increase in short positions. However, this did not significantly affect the ratio of buyers to sellers, with the former still outnumbering the latter by nearly two and a half times. The data on the UK labor market and inflation have negatively impacted the pound's upward potential, as everything points toward further interest rate cuts in the UK, which is unfavorable for the national currency. This week, there is no significant economic data, so all eyes will be on the statements from Bank of England representatives, which could provide insights into the central bank's future policy. The latest COT report shows that long non-commercial positions decreased by 5,743 to 151,923, while short non-commercial positions increased by 1,590 to 66,121. As a result, the spread between long and short positions narrowed by 212.

Indicator Signals:

Moving Averages:

Trading is below the 30- and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of moving averages on the H1 hourly chart, which differs from the standard definition of classic daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the indicator's lower boundary, around 1.2900, will serve as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise. Period 50 is marked in yellow on the chart.

- Moving Average (MA): Period 30 is marked green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes, meeting specific requirements.

- Long non-commercial positions: Represents the total open long positions of non-commercial traders.

- Short non-commercial positions: Represents the total open short positions of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.