Bitcoin completed its correction phase, recovering above $59,700-$61,000. Now the cryptocurrency is in the phase of price stabilization and accumulation of necessary volumes to start full-fledged growth. Meanwhile, big companies continue to buy BTC and as of October 29, whales own 49% of all traded bitcoins. The share of institutional investors in the market has grown significantly over the previous six months, making the asset more stable. In addition, the increase in large-cap investments has contributed to more fundamental changes in the entire bitcoin market.

According to cryptocurrency analyst Willie Woo, the current bullish bitcoin market may differ from the previous by performance and duration. The expert believes that the bitcoin price will rise for at least six months. Given relatively positive news, the rally could last for a year. Institutional investors, who launched an accumulation period at the end of last year, completely changed the disposition of the BTC market. Thanks to large investments, the cycles of growth and correction of the cryptocurrency have expanded significantly. This is due to an increase in the number of long-term players who are in no hurry to make transactions while waiting for the perfect moment. Woo believes that in addition to continuing the current bullish market, bitcoin's price may reach $100,000.

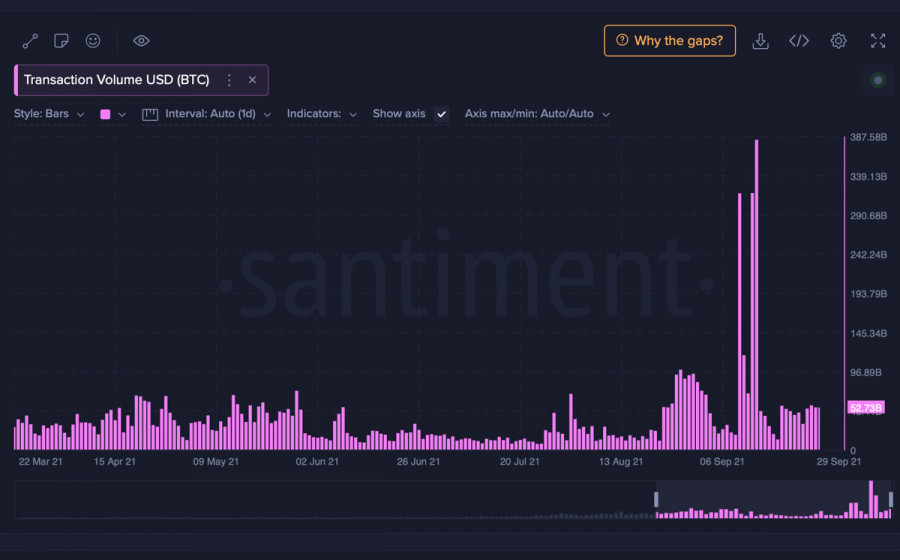

Analyzing the expert's point of view, it is possible to find common points of convergence. For example, the onchain analysis shows that, compared to previous periods of growth, coin migration has significantly decreased. This confirms the thesis that the market is becoming calmer and more balanced. Transaction volumes are also down 15% from winter to spring 2021, which also indicates a growing number of bulls holding their positions. It is likely that the process of stretching market cycles has indeed begun, but it is very likely that it will only gain momentum in the near future. This will be influenced by a new type of bitcoin investment, which began with the softening of the US policy on cryptocurrencies. The launch of bitcoin ETFs is the first step in the full-scale introduction of BTC into the state's economy. For example, large pension funds invested in the asset to protect their accounts from inflation. The US authorities are preparing a bitcoin plan for the country's banks, which is also a new stage of investment in the digital asset.

Considering all the above, we may expect more expansion of BTC growth and correction, as well as an increase in the number of institutional investors. Currently, we may observe the preconditions for the retail reduction. On the one hand, bitcoin may not be used by a large number of people, but on the other hand, it considerably decreases volatility. The drop of October 27 vividly demonstrates how the bitcoin market grew, because, with a sharp decrease in price by $6,000, there was no local sell-off. This indicates the maturity and long-term interests of the BTC traders.

Meanwhile, bitcoin continues to hover in a narrow range of $60,000-$63,500 with daily trading volumes around $48 billion. Bitcoin charts indicate the continuation of the stabilization period with a gradual decline to the lower boundary of the trading channel. The MACD indicator on the daily chart has formed a bearish cross and keeps going down. It is likely that the MACD indicator may break through the zero level, which will cancel a possible short-term upward momentum. The RSI is slowly declining towards 40, indicating an increase in the number of sales and a lack of strong buyers. The stochastic oscillator is about to form a bullish crossover, but most likely this pattern will be canceled. The price may continue to decline and if the bulls do not manage to stop the fall above $60,000, a retest of $57,000-$60,000 is likely to happen.

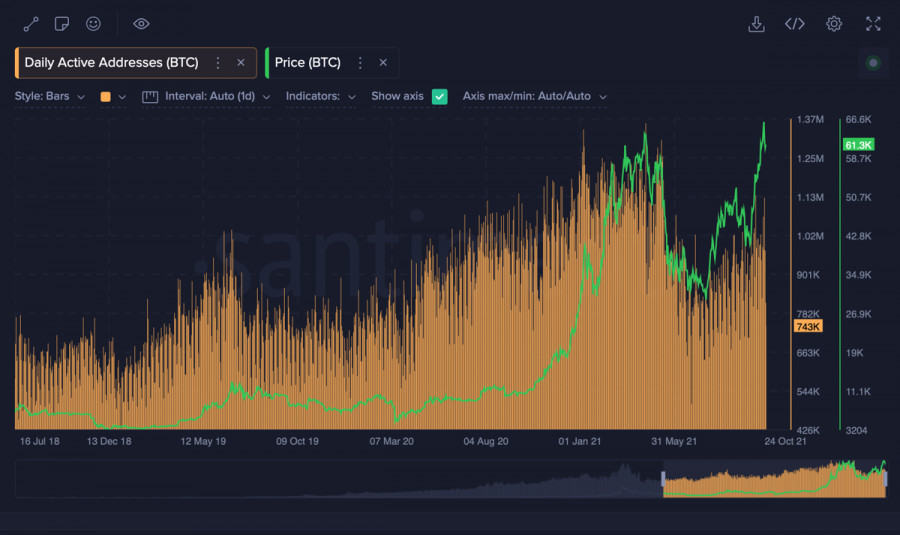

Bitcoin's onchain activity continues to remain at a high level, indicating that traders are ready to open long positions. The number of unique addresses of the BTC network remains at 1 million, which is a bullish signal and indicates a high level of activity. Transaction volumes are also at the level when the all-time high was set, and therefore we may expect the price to stabilize, after which the quotes will begin to recover. In general, the market is still bullish and the local period of fluctuations and correction does not influence the players as negatively as before, which brings a new bullish rally closer.