#AAPL (Apple Inc.). 汇率和在线图表

货币转换器

27 Mar 2025 21:59

(-3.49%)

前一天收盘价

开盘价。

最后一个交易日的最高价。

最后一个交易日的最低价。

在过去52周的价格区间高点

在过去52周的价格区间低点

Apple Inc. is the American IT-giant and the most expensive company in the world. Its capitalization exceeds $450 billion and the brand value according to different estimates reaches $98 to $185 billion. The company was established in early 70’s in California by Steve Jobs and Steve Wozniak, and first registered on April 1, 1976. The IPO was launched on December 12, 1980. In total, 4.6 bln securities were sold at the initial cost of $3.6. Until 2004 the share price did not go over $40. However, after the company refocused on the mobile devices, the share price has multiplied by 6 times. Moreover, after the release of the iPad, the shares of Apple Inc. surged to the mark of $700. Now the asset turnover is about 900 billion and the unit price fluctuates around $500.

Apple Inc. share price has been growing by approximately 16.1% for the last three years. The dividend yield equals 2.23% and EPS 42% a year. Cost of securities is directly bound to the quarterly reports and new devices releases. The main income of Apple Inc. is constituted by expanding iPhone sales, which comprise about 67% of gross income. Consequently, the company’s share value is much influenced by the success of new Apple smartphones.

See Also

- President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.

Author: Gleb Frank

12:15 2025-03-27 UTC+2

1900

US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and EuropeAuthor: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1780

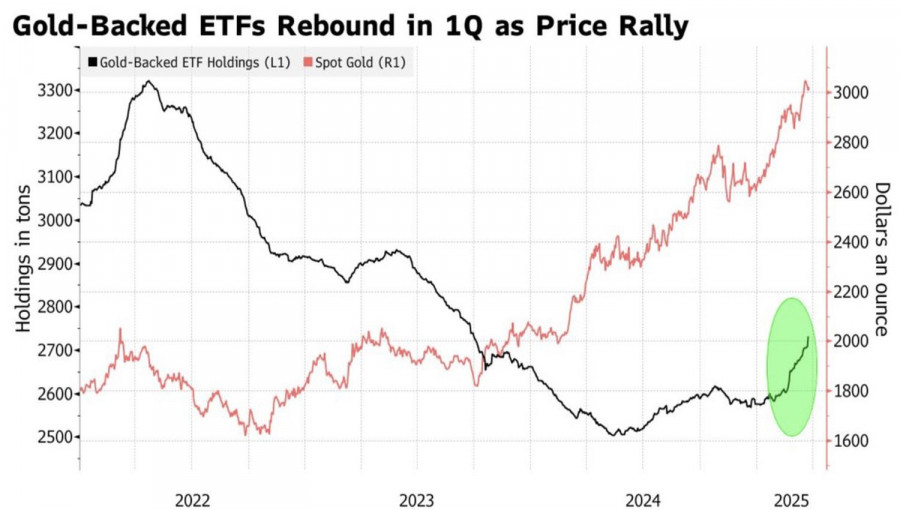

Trade tensions are driving demand for safe-haven assets.Author: Irina Yanina

11:44 2025-03-27 UTC+2

1765

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1735

The US crypto regulation bill is progressing rapidly through the legislative process.Author: Jakub Novak

11:52 2025-03-27 UTC+2

1630

Once you understand how the system works, winning isn't hardAuthor: Marek Petkovich

11:55 2025-03-27 UTC+2

1630

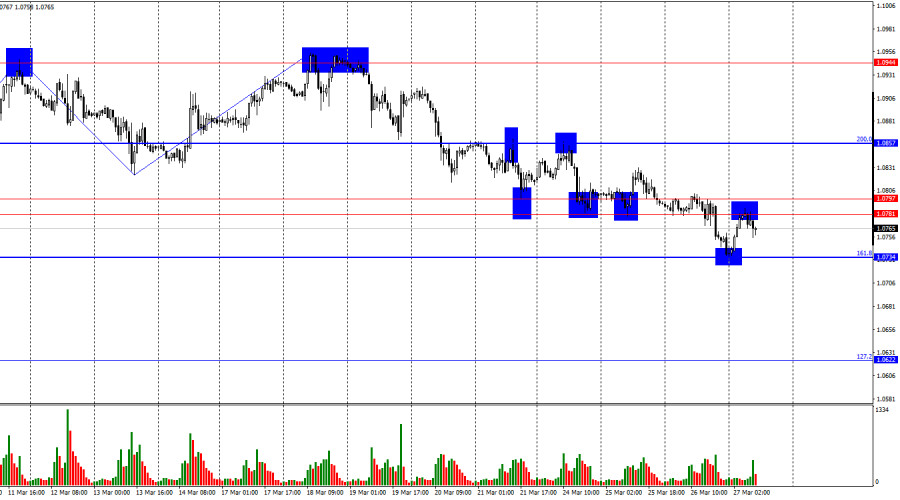

- Technical analysis

Trading Signals for EUR/USD for March 27-29, 2025: buy above 1.0790 (21 SMA - 8/8 Murray)

If the euro continues its rebound and consolidates above 1.0790 in the coming hours, we could expect EUR/USD to continue rising. So, the instrument could reach +2/8 Murray at 1.0986 in the short term and even the psychological level of 1.10.Author: Dimitrios Zappas

14:55 2025-03-27 UTC+2

1450

Bulls had been attacking for two weeks, but their strength had run out.Author: Samir Klishi

11:37 2025-03-27 UTC+2

1405

Technical analysisTrading Signals for GOLD (XAU/USD) for March 27-29, 2025: sell below $3,057 (double top - 7/8 Murray)

If gold fails to break above 3,057, it will be seen as a signal to sell with a target at 3,023. Moreover, we could expect it to reach the 200 EMA around 2,938 in the short term.Author: Dimitrios Zappas

14:54 2025-03-27 UTC+2

1360

- President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.

Author: Gleb Frank

12:15 2025-03-27 UTC+2

1900

- US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and Europe

Author: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1780

- Trade tensions are driving demand for safe-haven assets.

Author: Irina Yanina

11:44 2025-03-27 UTC+2

1765

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1735

- The US crypto regulation bill is progressing rapidly through the legislative process.

Author: Jakub Novak

11:52 2025-03-27 UTC+2

1630

- Once you understand how the system works, winning isn't hard

Author: Marek Petkovich

11:55 2025-03-27 UTC+2

1630

- Technical analysis

Trading Signals for EUR/USD for March 27-29, 2025: buy above 1.0790 (21 SMA - 8/8 Murray)

If the euro continues its rebound and consolidates above 1.0790 in the coming hours, we could expect EUR/USD to continue rising. So, the instrument could reach +2/8 Murray at 1.0986 in the short term and even the psychological level of 1.10.Author: Dimitrios Zappas

14:55 2025-03-27 UTC+2

1450

- Bulls had been attacking for two weeks, but their strength had run out.

Author: Samir Klishi

11:37 2025-03-27 UTC+2

1405

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 27-29, 2025: sell below $3,057 (double top - 7/8 Murray)

If gold fails to break above 3,057, it will be seen as a signal to sell with a target at 3,023. Moreover, we could expect it to reach the 200 EMA around 2,938 in the short term.Author: Dimitrios Zappas

14:54 2025-03-27 UTC+2

1360