The issue of China Evergrande, although it no longer has such a strong impact on the US market as before, but if the developer goes bankrupt, it certainly will not pass without a trace. According to recent reports, China Evergrande is going to attract about $273 million by selling its remaining shares in the movie and video streaming company, HengTen Networks. Experts compared these actions with the attempt to grab at straws before finally hitting the bottom. Amid this background Evergrande shares fell on Thursday by 5.7%, but HengTen securities jumped by almost 25% - apparently investors are happy with the fact that the company will not drag them to the bottom.

China Evergrande

Evergrande, China's largest dollar-denominated debt issuer among Chinese developers, is on the verge of total default this year.

S&P Global Ratings analysts consider that with China Evergrande so heavily indebted, it is only a matter of time before it defaults. The fact that the company has essentially lost its core business, which could have helped it through tough times, is the main reason for all the problems. Evergrande was China's second-largest developer by sales last year. Like many Chinese developers, the company sold apartments to consumers before construction was completed, helping generate capital for future projects. The S&P report said that despite the company's current ability to sell assets and find ways to make payments on time, Evergrande's massive debt may soon destroy the company. The company has lost the ability to build and sell new homes. It means that its core business model has effectively ceased to exist. This makes it unlikely to pay off existing debts in full without selling the core business and restarting it.

A more serious test for Evergrande, and most likely a default, will be the repayment of debt of $3.5 billion in March and April next year, according to S&P Global Ratings.

Indices are increasing

Meanwhile, US stock index futures are showing gains in morning trading on Thursday, after a slight decline on Wednesday. Dow Jones futures rose by 72 points, or 0.2%. The S&P 500 index futures jumped by 0.3%, and the Nasdaq 100 index futures increased by 0.5%.

The Dow Jones Industrial Average index declined by 211 points yesterday due to a 4.7% drop in Visa stock. The S&P 500 index was down by 0.26%. The Nasdaq Composite index plummeted by about 0.33% despite the fact that most large-cap tech companies closed the trading day with gains. The fact that many people are again seriously talking about another wave of COVID-19 overshadows the positive sentiment of the latest economic reports, which are the driver of American markets growth this week. At least they keep the indices around the all-time highs.

Concerns about COVID-19 have also triggered 10-year bond yields to fall for the first time in 6 days and put downward pressure on commodities. Another Covid outbreak would again stop economic activity, which would have a negative impact on the economy. At this point, it will be hard to predict how the stock market will react and cope with the issue.

The Labor Department is expected to release today data on initial jobless claims in the US for last week. Economists expect initial claims to fall to 260,000 for the week ended November 13.

As for the US premarket:

Nvidia shares jumped by 7.4% at the premarket after quarterly results exceeded the forecasts.

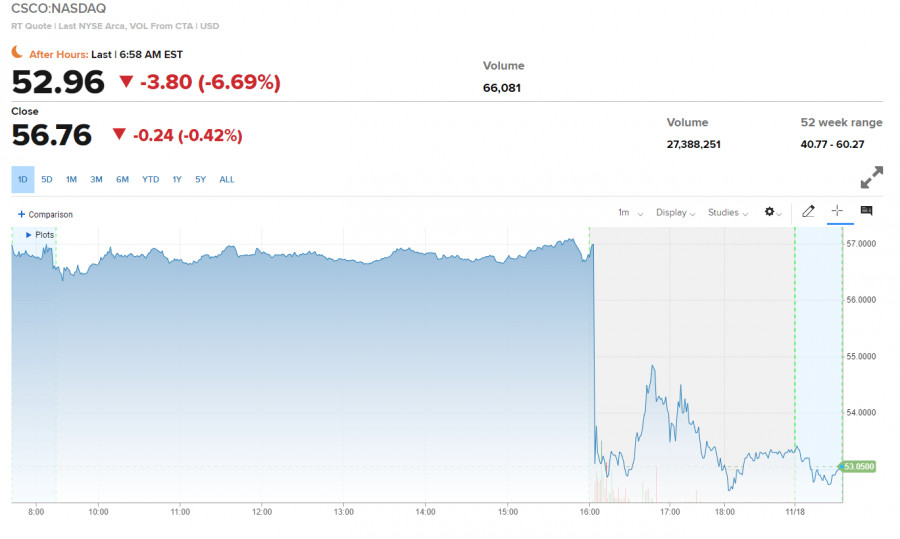

On the contrary, Cisco Systems fell by 7% due to weaker revenue forecasts and lost profits.

Boeing shares continued to rise today during the premarket. Good news yesterday about another airplane contract supported the market, and today's rise of 2% came after JP Morgan upgraded the aerospace giant, which said: the aerospace giant has significant upside potential as it has fixed a number of problems that have plagued the company in the past.

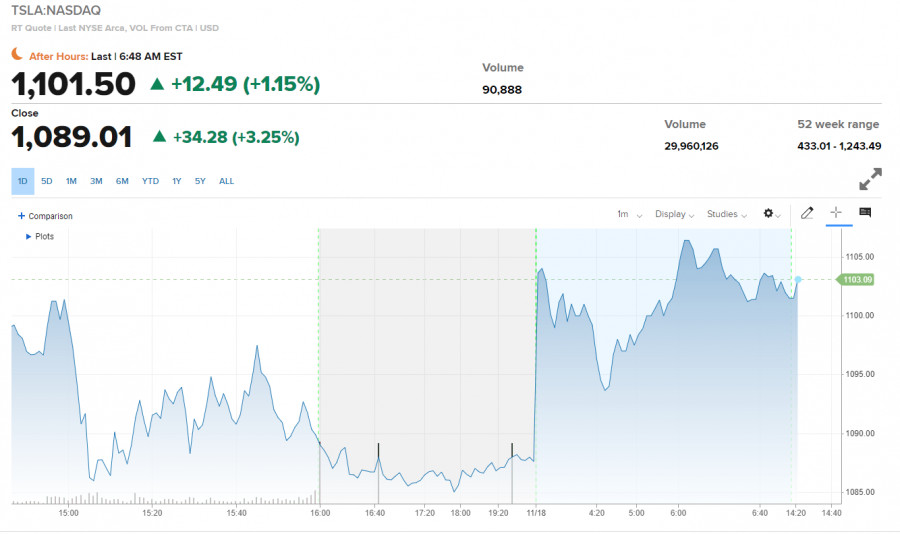

Tesla's shares increased by 1.15% during the premarket after news about Elon Musk's intention to sell about 10% of his shares began to fade.

As for the S&P500 index:

It is gradually returning to its all-time high of $4,718 as investors hope for a more positive end of the year and for the Federal Reserve's policy to remain soft. Support is located at $4,660. If the price breaks through this level it may increase pressure on the trading instrument and lead to a larger drop of the index to $4,609 and $4,551. If the price breaks through the level of $4,718 it is likely to pave the way to $4,750 and $4,775.