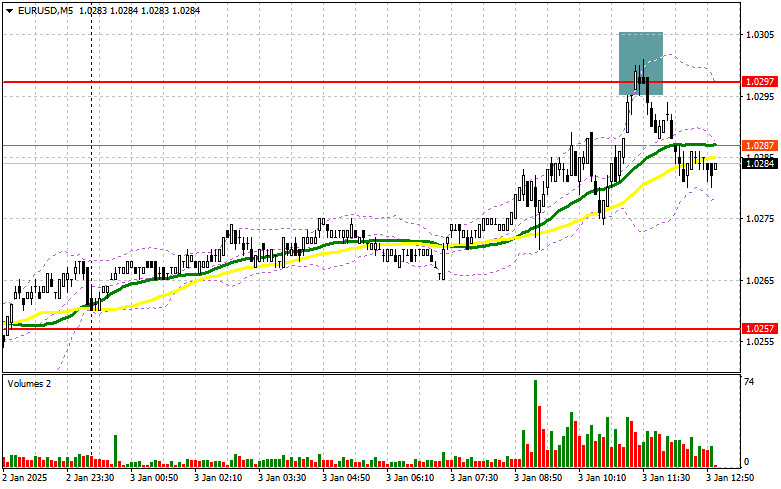

In my morning forecast, I highlighted the level of 1.0297 as a key point for making market entry decisions. Let's review the 5-minute chart to analyze what happened. The rise and the formation of a false breakout around 1.0297 allowed for short positions, resulting in a 15-point drop in the pair, but that was all for now. The technical picture has not been revised for the second half of the day.

For opening long positions on EUR/USD:

The euro saw selling near 1.0297, but the large player that drove the pair down throughout the previous day has yet to reappear. It seems market participants are focusing on new US statistics, which could help restore the dollar's advantage. This afternoon, the US ISM Manufacturing Index data and a speech by FOMC member Thomas Barkin are expected. Barkin is among the first to provide insights into the Federal Reserve's future policies for the year.

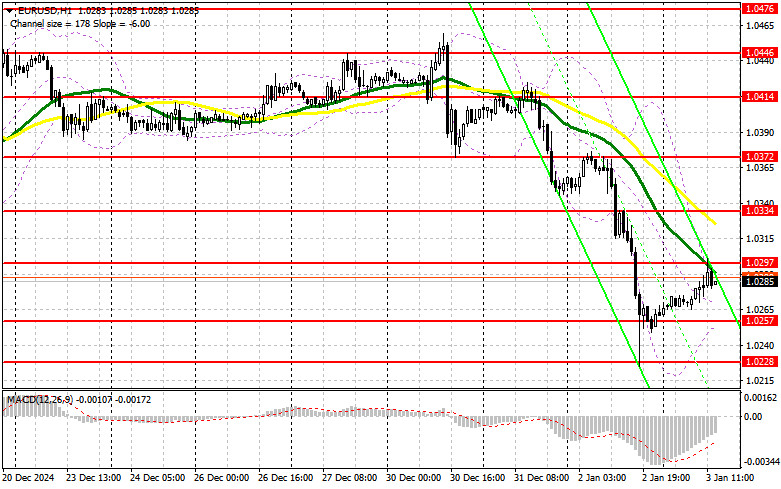

Given the lack of active euro sellers, weak data could lead to another wave of growth, extending the pair's correction. If the pair declines in reaction to the data, bulls will need to defend the support at 1.0257, which was not reached in the morning. A false breakout at this level would create an ideal condition for increasing long positions, aiming for a return to 1.0297. A breakout and retest of this range would confirm the correct entry point for purchases, targeting an update to 1.0334. The farthest target would be the 1.0372 level, where profits would be taken.

If EUR/USD declines further without activity near 1.0257 in the afternoon, the pair will face additional pressure, leading to a larger euro drop. In this case, I would only consider long positions after a false breakout near the 1.0228 support level. Alternatively, buying on a rebound from 1.0180 with an intraday upward correction of 30–35 points is possible.

For opening short positions on EUR/USD:

If the euro rises further on weak US data, defending the resistance at 1.0297 remains the sellers' priority. A false breakout there, similar to this morning's scenario, would return bearish momentum and provide an entry point for short positions, targeting the support at 1.0257. Breaking and consolidating below this range, followed by a retest from below, would be another good opportunity to sell, targeting the monthly low of 1.0228, which would undermine buyers' plans for further correction. The farthest target would be the 1.0180 level, where profits would be taken.

If EUR/USD continues upward this afternoon and bears fail to act near 1.0297 (where the moving averages favor sellers), short positions will be deferred until the next resistance at 1.0334. Selling at this level would only occur after an unsuccessful consolidation. Alternatively, I plan to open short positions on a rebound from 1.0372, aiming for a 30–35 point downward correction.

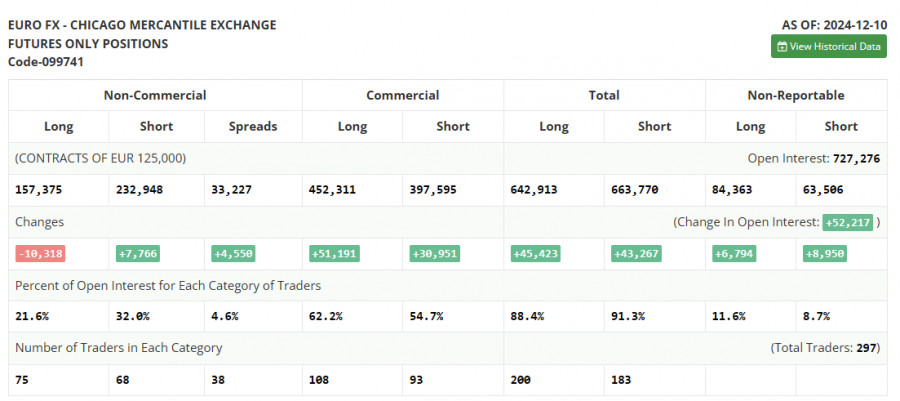

The COT (Commitment of Traders) report for December 10 showed an increase in short positions and a decrease in longs, leaving the overall market setup largely unchanged. The upcoming final Federal Reserve meeting of the year is expected to result in a rate cut, which has recently capped dollar growth and maintained demand for risk assets. A more cautious Fed approach for next year could significantly increase the chances of a bearish EUR/USD market returning. The COT report indicated that long non-commercial positions fell by 10,318 to 157,375, while short non-commercial positions rose by 7,766 to 232,948. The gap between long and short positions widened by 4,450.

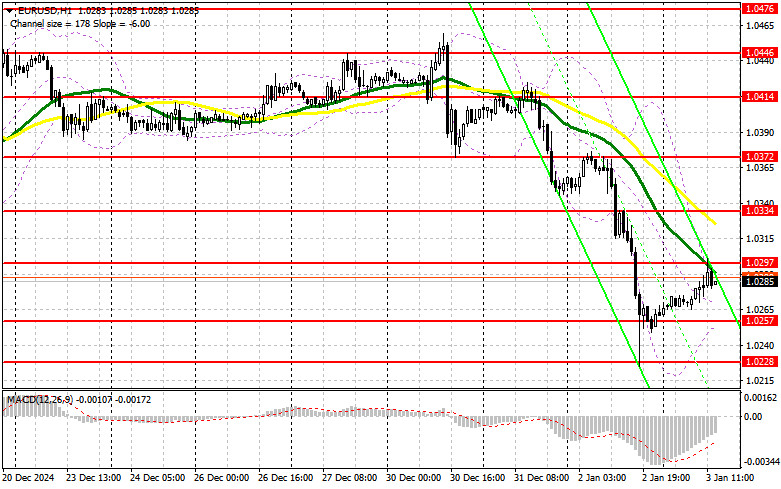

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating a bearish trend for the euro.

(Note: The author analyzes moving averages on the H1 chart, which differs from the classic daily moving averages on the D1 chart.)

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator around 1.0257 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise (Period 50 is marked in yellow; Period 30 is marked in green).

- MACD: Moving Average Convergence/Divergence (Fast EMA – Period 12; Slow EMA – Period 26; SMA – Period 9).

- Bollinger Bands: Measures volatility (Period 20).

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes.

- Non-commercial Long Positions: Represents the total long open positions of non-commercial traders.

- Non-commercial Short Positions: Represents the total short open positions of non-commercial traders.

- Net Non-commercial Position: The difference between long and short positions of non-commercial traders.