Analysis of Thursday's Trades

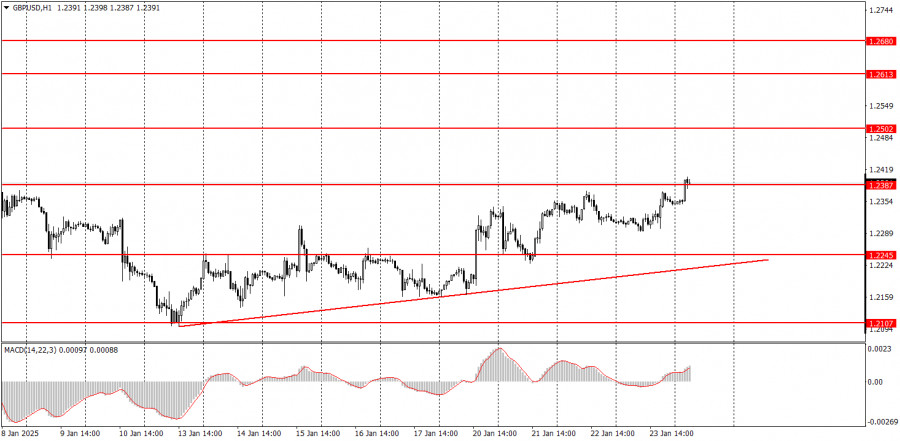

1H Chart of GBP/USD

On Thursday, the GBP/USD pair continued to rise, even though there were no local macroeconomic or fundamental factors driving this movement. Throughout the day, neither the US nor the UK published any significant reports. The jobless claims report from the US had little potential to influence the currency pair, as its actual figure closely matched the forecast. Consequently, there was nothing for market participants to respond to. The upward correction is still ongoing, as indicated by the price's position above the trendline, and this trend does not rely heavily on constant news or reports.

However, today, there will be a considerable amount of macroeconomic information released, which means the pair could either rise or fall with equal likelihood. We would like to emphasize to novice traders that the current movement is primarily corrective in nature.

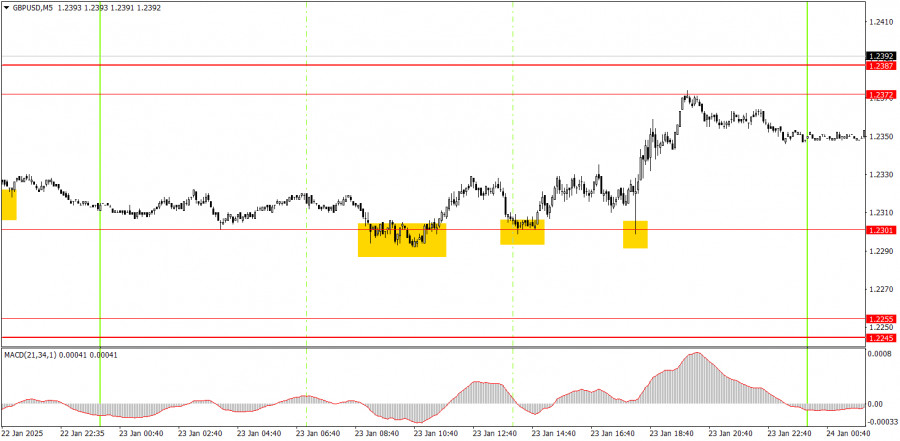

5M Chart of GBP/USD

In the 5-minute time frame on Thursday, the currency pair generated three trading signals near the 1.2301 level, which has recently transformed from 1.2316. As a result, the 1.2316 level was not relevant yesterday. For most of the day, the British pound traded sideways, only showing a significant upward movement in the evening. A rebound from the 1.2372 level could have been traded, but this signal was formed relatively late in the day.

Trading Strategy for Friday:

In the hourly time frame, the GBP/USD pair has begun a short-term upward trend, which is primarily a correction. From a medium-term perspective, we fully anticipate a decline in the pound toward the 1.1800 level, as we believe this is the most likely scenario. Therefore, traders should expect a drop, and the trendline will indicate the completion of the current correction.

On Friday, the GBP/USD pair may continue to trade relatively calmly, with the day's direction largely influenced by the macroeconomic backdrop. For the first time this week, reports may have a significant impact on the pair's movement.

On the 5-minute time frame, trading is currently possible at the following levels: 1.2010, 1.2052, 1.2089-1.2107, 1.2164-1.2170, 1.2241-1.2270, 1.2301, 1.2372-1.2387, 1.2445, 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2723, and 1.2791-1.2798. On Friday, business activity indices for the services and manufacturing sectors are set to be released in both the UK and the US. Additionally, the University of Michigan Consumer Sentiment Index will be published in the US. These reports have moderate importance but could still provoke a market reaction.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 20 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.