Bitcoin remains unwaveringly committed to an indifferent flat movement in the first days of January 2023. The cryptocurrency managed to achieve local success and form a green candle, thanks to which the asset reached the level of $16.8k.

However, if we trace the weekly path of Bitcoin to current positions, we can note low trading volumes, as well as low investment activity of long-term investors. Certain categories of hodlers continue to sell off their BTC holdings.

According to data from Glassnode, the number of addresses with a balance of more than 1,000 BTC has dropped to 2,000. The figure has reached a three-year low, indicating a lack of consensus among long-term investors regarding Bitcoin.

In part, this fact indicates that the period of large-scale consolidation and redistribution of BTC volumes continues. However, throughout 2022, the market became convinced that the best catalyst for the movement of BTC coins is a crisis situation and a sharp drop in price.

Is Bitcoin heading toward $10k?

According to experts of the largest investment company VanEck, the cryptocurrency market is heading for this scenario. Analysts are confident that the first quarter of 2023 will be characterized by an aggravation of crisis processes and high volatility.

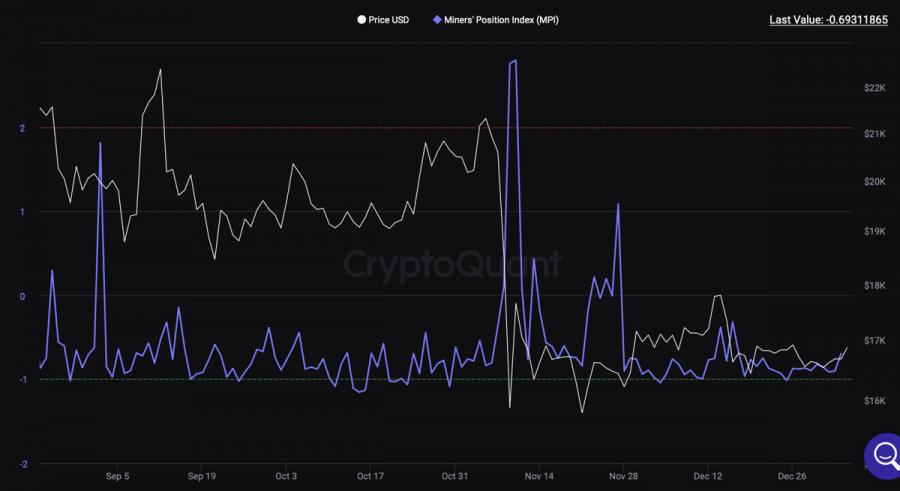

It is expected that Bitcoin will continue its downward movement and update the local bottom near the $10k–$12k levels. According to VanEck experts, this will be affected by the current state of the mining industry. The rise in the price of energy resources and the cost of mining BTC provoke huge losses among the miners.

Recall that, on average, for each BTC mined, mining companies incur a loss of about $3,000. It also recently became known that the total credit debt of public mining companies is more than $4 billion. VanEck experts consider these factors to be key in the future fall in the price of the cryptocurrency.

Recall that the warning about "several difficult months" was contained in a letter to the employees of the largest crypto exchange Binance. Also, the average percentage of BTC price drop from the high is 85%. As part of the current bear market, the asset lost about 77%.

Presumably, when the price of Bitcoin reaches the $10k–$12k area, the percentage of the fall from the high will be approximately 82%–85%. Given these data, forecasts from VanEck experts have every chance of becoming a reality.

SPX and Bitcoin

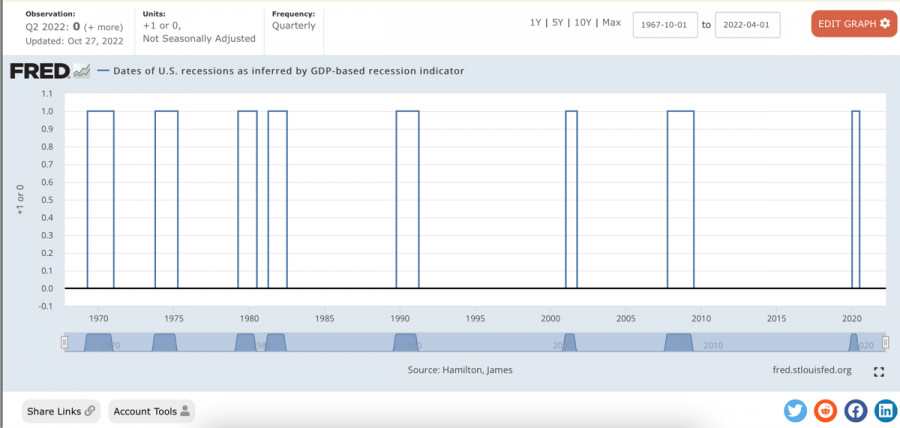

A regular guest of analysis of the situation around Bitcoin, the S&P 500 index is more relevant today than ever. If you look at the SPX annual price chart, you can see that despite the massive drop after 2021, the asset is still overheated.

Given the approaching recession and the focus of investors on capital preservation, the fall of SPX may continue. Bank of America and BNP Paribas forecast that the S&P 500 will end 2023 at $3,400.

As of January 4, the stock index quotes are close to $3,800. A fall to the $3,400 level will mean that the asset's capitalization will lose another 8%–10%. Given that SPX is the flagship of the stock market, a corresponding movement should be expected on other instruments.

BTC/USD Analysis

In the medium term, there is every reason to believe that Bitcoin will update the local bottom, which will cause the next stage of capitulation and redistribution of capital. At a distance of a year, the asset may resume its upward movement and reach the level of $30k, according to VanEck experts.

A key factor in the recovery movement of the Bitcoin price may be a reversal of the Fed's policy. More than 2/3 of economists from the 23 largest financial institutions expect the Fed to ease monetary policy in the second half of 2023, according to a WSJ survey.

U.S. Federal Reserve Chairman Jerome Powell said there are plans to increase the key rate to the 5%–5.5% level. At current rates, the indicator will reach the indicated milestone by March–April 2023, just in time for the end of the first quarter of 2023.

Results

The crypto market has survived most of the bear market, however, many factors point to the need for a final dive. Given this, we should not expect significant recovery movements in the BTC price in the first half of 2023.

The main stage of the price recovery and consolidation movement in preparation for the 2024 bull market will begin in the second half of 2023. Until then, the investment environment in the crypto market will be toxic and unattractive due to the recession and future bankruptcies of crypto companies.