Analysis of Trades and Trading Tips for the Euro

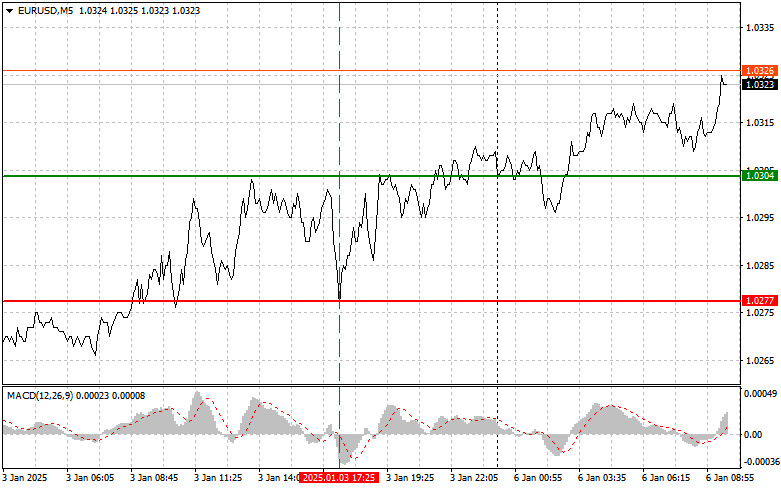

In the second half of the day, the test of the 1.0277 price level coincided with the MACD indicator being significantly below the zero mark, limiting the pair's downward potential. For this reason, I refrained from selling the euro.

The release of U.S. economic data on Friday strengthened the dollar against the euro, but sellers couldn't maintain control for long. Despite the euro's struggles against the dollar, buyers of risk assets may attempt to recover another part of the losses today, leaving the "battle" for direction unresolved.

Today, the focus will be on critical data, including the eurozone services PMI and the composite PMI for December last year. These indicators will be essential for assessing the current state of the eurozone economy, particularly amidst challenges like high interest rates and geopolitical uncertainty. The Services PMI, the region's main driver of economic growth, can show how resilient demand for services remains. The Composite PMI, which combines data on the manufacturing and services sectors, will offer a more comprehensive view of economic dynamics. Economists expect the figures to remain below 50, indicating business activity contraction. Economists anticipate that the readings may stay below the 50-point threshold, signaling a contraction in business activity. Persistent trends in this range could heighten concerns about the eurozone's growth prospects. If the data exceeds expectations, it might boost investor optimism and ease pressure on the European Central Bank.

I will primarily rely on executing Scenario #1 and Scenario #2 for today's trading. These approaches will guide my decisions based on market conditions and potential reactions to the PMI data.

Buy Signal

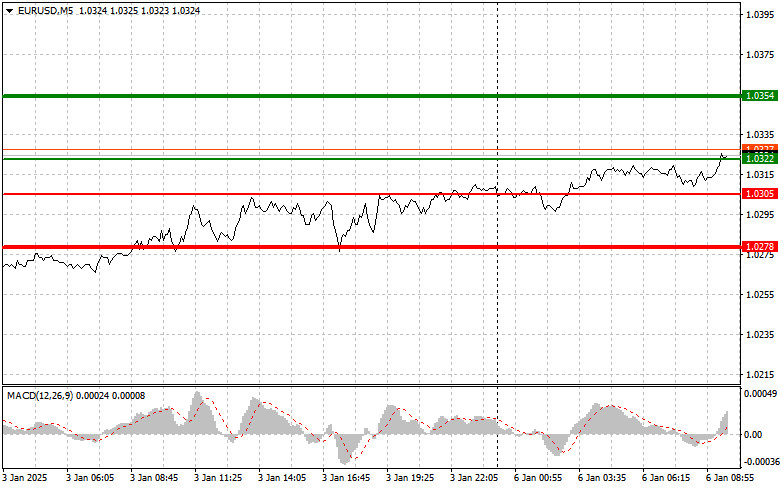

Scenario #1: Today, I plan to buy the euro upon reaching the price level of 1.0322 (green line on the chart), aiming for an increase to 1.0354. At 1.0354, I plan to exit the market and sell the euro in the opposite direction, expecting a movement of 30–35 pips from the entry point. A strong euro rally in the first half of the day is only likely if positive PMI data are released. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.0305 price level, provided the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. A rise toward the opposing levels of 1.0322 and 1.0354 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches the 1.0305 level (red line on the chart). The target will be 1.0278, where I plan to exit the market and immediately buy in the opposite direction, expecting a movement of 20–25 pips from this level. Downward pressure on the pair can resume at any moment. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.0322 price level, provided the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposing levels of 1.0305 and 1.0278 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.