The EUR/USD currency pair experienced a significant drop once again on Wednesday. Let's briefly review the sequence of events. On Monday, the euro surged unexpectedly, seemingly due to the German inflation report. However, this surge began well before the report was published, suggesting that market makers may have acted on insider information. The euro's rise was not coincidental; traders quickly began to anticipate a significant increase in consumer prices across the Eurozone, especially given Germany's traditional role as the engine of Europe's economy—at least, it had been for a long time.

Despite the heightened expectations, Eurozone inflation rose in line with forecasts, leading the market to sell off the euro. Hopes for a slower pace of monetary easing by the European Central Bank (ECB) quickly faded. On Wednesday, the euro continued to decline, even ahead of any macroeconomic reports. While the weaker-than-expected German retail sales report likely wasn't the sole reason for a nearly 100-pip drop, it did provide formal, albeit local, justification for the market's decision to shed the euro.

Global factors continue to show a downward trend. Even when the EUR/USD pair rose to the Murray level of "3/8" at 1.0437, we advised caution against making hasty conclusions. The downtrend is still in place, and the fundamental backdrop remains unchanged. So, why should we expect a significant rally in the euro? While the pair may need to correct occasionally on the daily and weekly timeframes, identifying a correction on higher timeframes requires strong signals and solid reasons. What do we observe on the daily chart? The price couldn't even consolidate above the critical line, which was well within reach. On the 4-hour timeframe, the price breached the moving average but failed to surpass the last local high. In summary, there are no strong signals indicating a trend reversal.

Additionally, hopes for a pause in ECB monetary easing diminished with the recent European inflation report. Regarding Donald Trump and his statements, opinions may differ, but their implications do little to reassure the global outlook. Beyond the potential for trade wars with nearly all major trading partners, Trump has made bold claims about purchasing Greenland, annexing Canada, and controlling the Panama Canal. Frankly, we are surprised he hasn't expressed ambitions to annex China or turn Australia into a colony.

Trump's first term as president showed the world that he talks frequently, rarely tells the truth, and accomplishes even less. He is a media personality who craves constant attention, always wanting to see his name in the headlines. Much of what he says serves as a form of publicity. What difference does it make what he claims when even Americans treat his statements as a joke? It's worth noting that this is the same Trump who promised to end the conflict in Ukraine within 24 hours of winning the election.

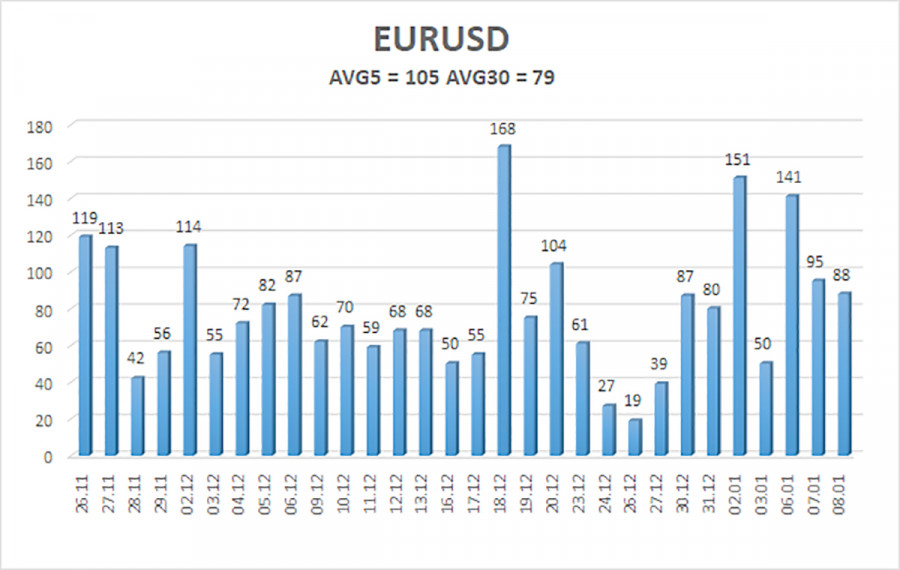

The average volatility of the EUR/USD currency pair over the last five trading days stands at 105 pips, classified as "high." On Thursday, we anticipate the pair to move from 1.0200 to 1.0410. The higher linear regression channel remains downward, indicating that the overall bearish trend persists. The CCI indicator has again entered the oversold territory and formed a new bullish divergence. However, this signal continues to suggest, at most, a correction.

Nearest Support Levels:

- S1 – 1.0254

- S2 – 1.0193

- S3 – 1.0132

Nearest Resistance Levels:

- R1 – 1.0315

- R2 – 1.0376

- R3 – 1.0437

Trading Recommendations:

The EUR/USD pair is expected to continue its downtrend, which remains firmly intact. In recent months, we have consistently indicated our expectation for further depreciation of the euro in the medium term, fully supporting the prevailing bearish trend. It is highly likely that the market has already factored in all anticipated Federal Reserve rate cuts. Therefore, there are currently no compelling reasons for the US dollar to weaken in the medium term, except for potential technical corrections.

Short positions are still relevant, with targets set at 1.0254 and 1.0200. For those trading based purely on technical signals, long positions may be considered if the price rises above the moving average, targeting 1.0437. However, any upward movement at this point is categorized as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.