Trade Analysis and Tips for Trading the Euro

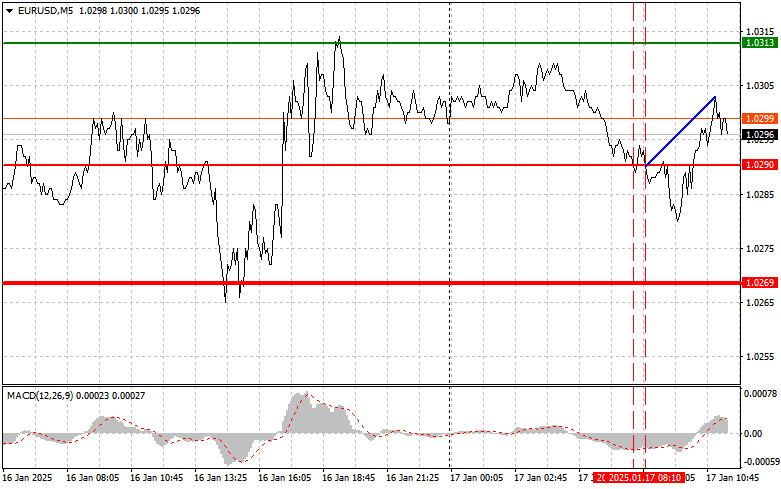

The first test of the 1.0290 price occurred when the MACD indicator had already moved far below the zero mark, significantly limiting the pair's downward potential. For this reason, I did not sell the euro. A second test of this level shortly thereafter, when the MACD was in oversold territory, provided an opportunity to implement Scenario #2 for buying. However, as seen on the chart, this did not lead to any significant upward movement, and the pair continued trading within a channel.

During the US session, investors' attention will focus on several economic indicators that could significantly impact financial markets. One key event will be the publication of data on building permits, which serves as a barometer of future construction activity and can signal the state of the housing market and overall economic growth. If the figures exceed forecasts, this could strengthen the dollar.

Additionally, it is important to monitor data on housing starts, often seen as a leading indicator of future demand for housing and construction materials. An increase in housing starts could indicate a recovery in the real estate market, providing a positive signal for economists and investors.

Finally, changes in industrial production volumes will significantly influence market sentiment. Growth in production could indicate strengthening in the manufacturing sector and overall economic improvement. On the other hand, negative data—considering the challenges faced by the US manufacturing sector—could put pressure on the dollar. If the data meets economists' forecasts, trading will likely remain within the existing sideways channel.

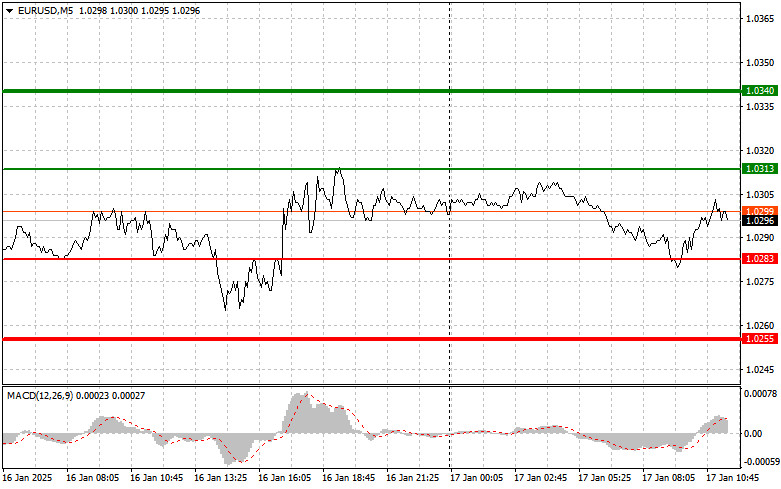

For intraday strategy, I will focus on implementing Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, buying the euro is possible at 1.0313 (green line on the chart) with a target of 1.0340. At 1.0340, I plan to exit the market and also sell the euro for a potential 30-35 point pullback. Euro growth today could be expected after weak US data.Important: Before buying, ensure that the MACD indicator is above the zero mark and just beginning its upward movement.

Scenario #2: I also plan to buy the euro in the case of two consecutive tests of 1.0283, with the MACD indicator in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. Growth toward the opposing levels of 1.0313 and 1.0340 can then be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.0283 (red line on the chart). The target will be 1.0255, where I plan to exit the market and immediately open a buy position for a potential 20-25 point pullback. Selling pressure on the pair could return in the case of strong data.Important: Before selling, ensure that the MACD indicator is below the zero mark and just beginning its downward movement.

Scenario #2: I also plan to sell the euro in the case of two consecutive tests of 1.0313, with the MACD indicator in overbought territory. This will limit the pair's upward potential and lead to a market reversal downward. Declines toward the opposing levels of 1.0283 and 1.0255 can then be expected.

Chart Overview

- Thin green line: Entry price for buying the instrument.

- Thick green line: Expected price where Take Profit can be set or profits can be manually locked in, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the instrument.

- Thick red line: Expected price where Take Profit can be set or profits can be manually locked in, as further declines below this level are unlikely.

- MACD Indicator: Key for determining overbought and oversold zones when entering the market.

Important Notes for Beginner Traders:

- Carefully evaluate market entry decisions, especially before significant fundamental reports. Avoid trading during news releases to minimize exposure to sharp price swings.

- Always place stop-loss orders to minimize losses. Without stop-loss orders, you could quickly lose your entire deposit, especially when trading large volumes without proper money management.

- For successful trading, always have a clear trading plan, such as the one outlined above. Spontaneous trading decisions based on current market conditions are typically a losing strategy for intraday traders.