Analysis of Trades and Trading Tips for the Euro

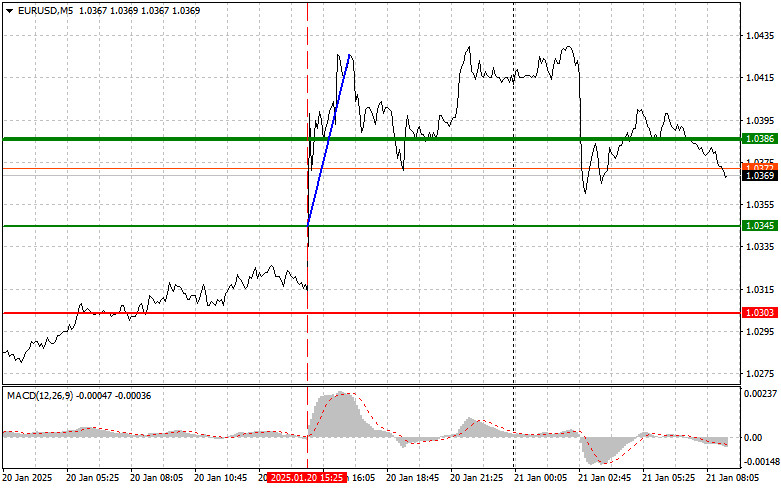

The test of the 1.0345 price in the second half of the day coincided with when the MACD indicator had just started moving upward from the zero mark, confirming a correct entry point into the market. As a result, the pair moved upward by more than 50 pips.

Markets are closely monitoring the potential consequences of additional tariff increases, which could significantly impact the global economy and various risk assets. Major economies, such as China and those in Europe, are exercising caution. Changes in tariff policy are expected to influence not only bilateral relations but also global supply chains. Higher import costs could lead to inflationary pressures and reduce consumer purchasing power, creating challenges for the European Central Bank (ECB), which plans to rapidly cut interest rates. Furthermore, new trade barriers may provoke retaliatory measures from partner countries, worsening the situation.

Today, the first half of the day will feature data releases, including the Eurozone ZEW Economic Sentiment Index, Germany's ZEW Economic Sentiment Index, and Germany's ZEW Current Conditions Index. These figures are expected to be quite weak, potentially offsetting yesterday's gains in EUR/USD. Investors are paying close attention to these indicators as they may signal slowing economic growth in the region. This could reignite discussions about the necessity for ECB support, increasing pressure on the euro. As the ECB meeting approaches, market participants will also focus on potential hints regarding future monetary policy changes. Weak reports may heighten expectations for more aggressive monetary easing in the future.

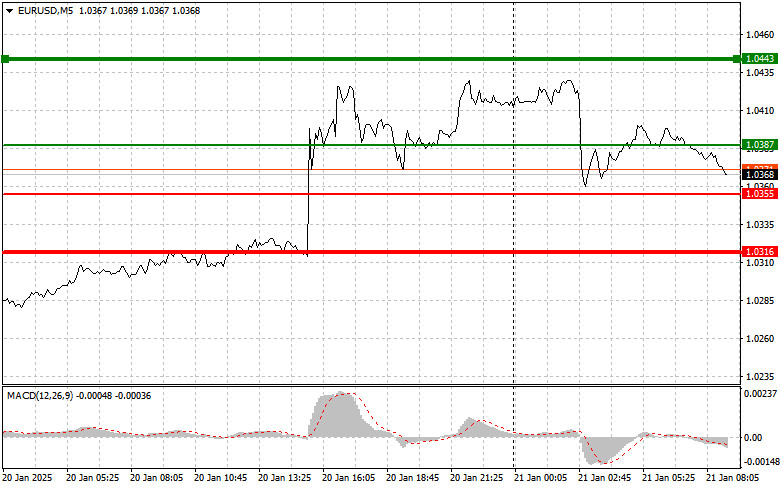

For intraday trading, I will mainly focus on implementing Scenario #1 and Scenario #2 for both buying and selling.

Buy Signal

Scenario #1: Buy the euro at 1.0387 (green line on the chart) with a target of 1.0443. I plan to exit the market at 1.0443 and sell the euro in the opposite direction, aiming for a movement of 30–35 pips from the entry point. Euro strength in the first half of the day will depend on favorable data. Important! Before entering a buy trade, ensure that the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: Buy the euro if the price tests 1.0355 twice consecutively while the MACD indicator is in the oversold area. This would limit the pair's downside potential and trigger an upward market reversal. Targets for this scenario are 1.0387 and 1.0443.

Sell Signal

Scenario #1: Sell the euro after it reaches 1.0355 (red line on the chart). The target will be 1.0316, where I plan to exit and immediately buy in the opposite direction, aiming for a movement of 20–25 pips from the level. Pressure on the pair could return at any moment. Important! Before entering a sell trade, ensure that the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: Sell the euro if the price tests 1.0387 twice consecutively while the MACD indicator is in the overbought area. This would limit the pair's upside potential and trigger a market reversal downward. Expected targets are 1.0355 and 1.0316.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.