Analysis of Trades and Trading Tips for the British Pound

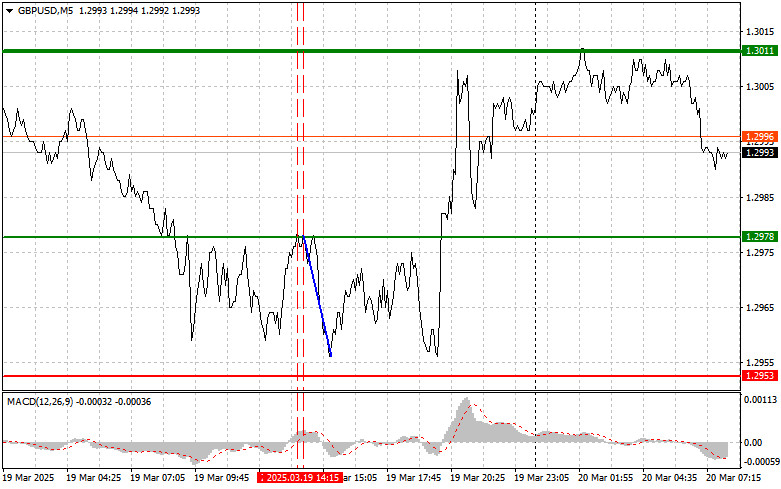

The price test at 1.2978 occurred when the MACD indicator moved significantly above the zero mark, limiting the pair's upward potential. For this reason, I did not buy the pound. The second test of 1.2978, with the MACD in the overbought zone, led to the execution of Scenario No. 2 for selling, resulting in a decline of more than 30 pips.

The Federal Reserve's decision to keep interest rates unchanged and a downward revision of economic forecasts exerted significant pressure on the U.S. dollar. The currency weakened in the foreign exchange market, with the British pound showing a notable rebound from its daily lows. Following the Fed meeting, the inflation forecast for the end of 2025 was raised to 2.8%, significantly higher than the previous estimate of 2.5% in December. At the same time, the Fed lowered its economic growth forecast to 1.7% by the end of 2025, down from the previous projection of 2.1%. These revisions to the economic outlook raised investor concerns and triggered capital redistribution, negatively impacting the dollar.

Today, market volatility may increase further as traders anticipate the Bank of England's key interest rate decision. The market will closely watch how the central bank assesses the current economic situation and inflation outlook. Special attention will be given to the speech by BoE Governor Andrew Bailey, as his comments may provide valuable insights into the future direction of monetary policy. Traders will be looking for signals on how determined the BoE is to combat inflation and what factors will shape its future actions.

Additionally, key labor market reports from the UK, including data on unemployment and changes in average earnings, are expected to be released today. These indicators will provide insights into the health of the British economy and could influence expectations regarding the BoE's future policies.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

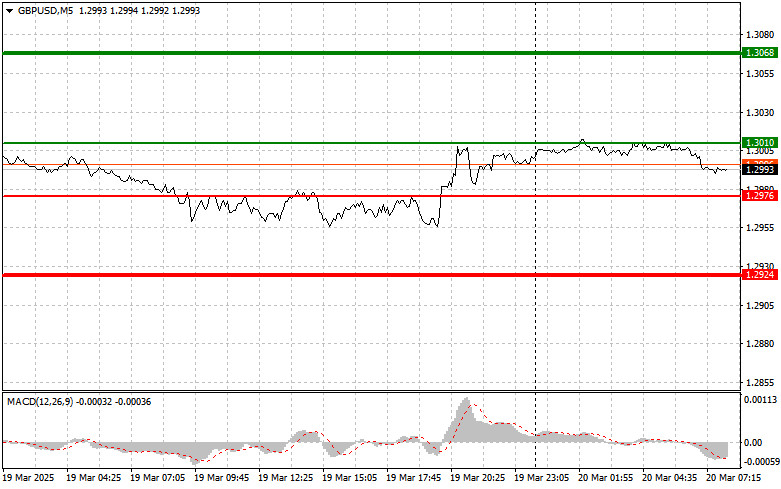

Scenario No. 1: Today, I plan to buy the pound at an entry point around 1.3010, aiming for a rise to 1.3068. At 1.3068, I intend to exit the buy trades and open sell positions in the opposite direction, expecting a movement of 30-35 pips from that level. The pound's growth can be anticipated to continue the upward trend. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario No. 2: I also plan to buy the pound if there are two consecutive tests of 1.2976 while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. A rise toward the opposite levels of 1.3010 and 1.3068 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after a breakout of 1.2976, which should lead to a rapid decline in the pair. The key target for sellers will be 1.2924, where I intend to exit the sell trades and immediately open buy positions in the opposite direction, expecting a movement of 20-25 pips from that level. Selling the pound is best done at higher levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario No. 2: I also plan to sell the pound if there are two consecutive tests of 1.3010 while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the opposite levels of 1.2976 and 1.2924 can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.