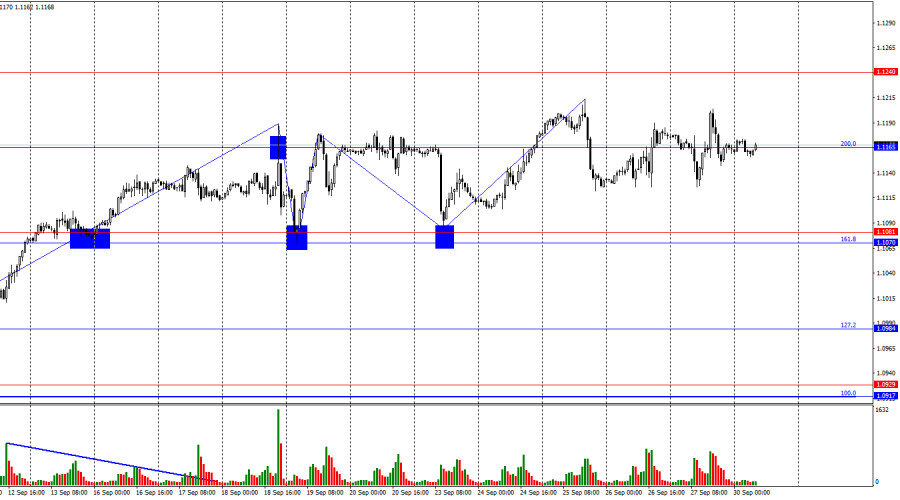

On Friday, the EUR/USD pair struggled to find a clear direction. Throughout the day, the price hovered around the 200.0% retracement level at 1.1165, showing little reaction to the news backdrop. Therefore, I don't consider the 1.1165 level to be strong, and we are unlikely to see trading signals forming around it. The bulls have cooled off a bit but are eagerly anticipating the new week.

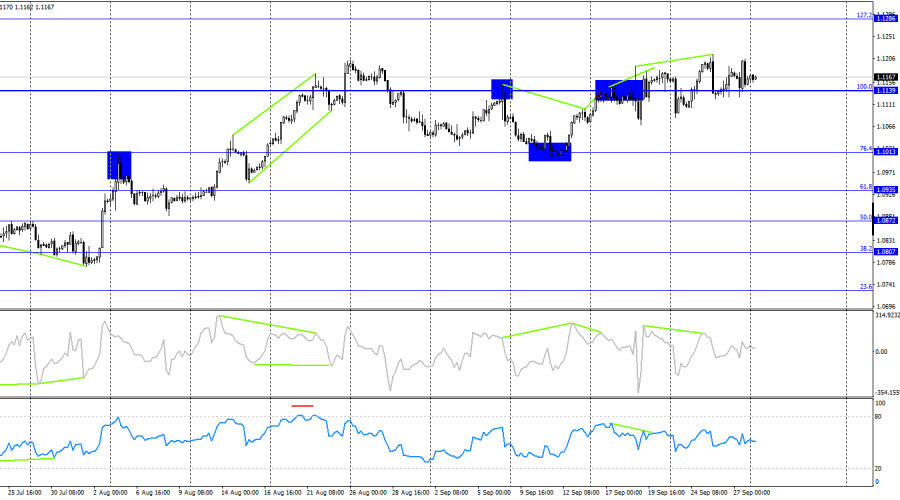

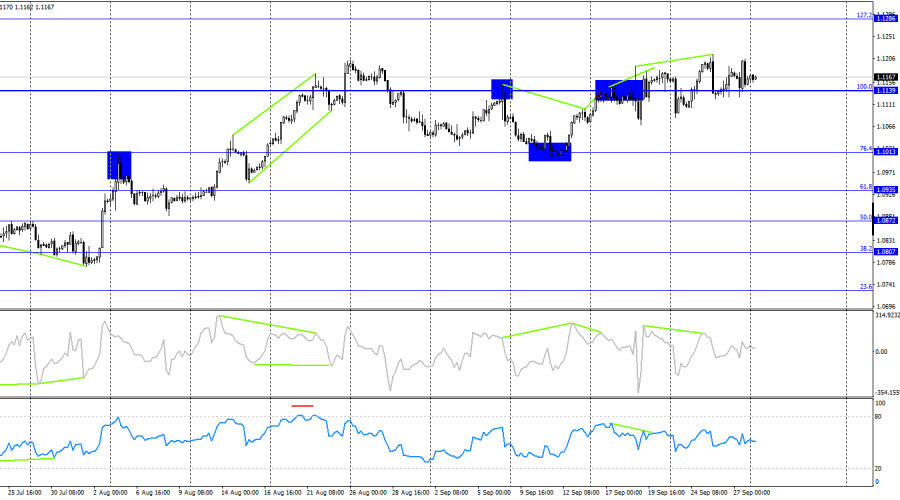

The wave analysis has become slightly more complex, but it remains largely clear. The last completed downward wave (September 19-23) did not break the low of the previous wave, while the new upward wave broke the peaks of the previous two waves. Therefore, the pair has either transitioned into a complex sideways pattern or is very slowly beginning to form a new "bullish" trend. A consolidation below the support zone of 1.1070 – 1.1081 would invalidate the emerging "bullish" trend.

The news backdrop on Friday suggested that traders might expect a slight decline in the pair, but it wasn't entirely clear-cut. The core Personal Consumption Expenditures (PCE) Price Index in the U.S. rose from 2.6% to 2.7% year-on-year but slowed from 0.2% to 0.1% month-on-month. Therefore, it's challenging to determine definitively whether the PCE index increased or slowed down. The Michigan Consumer Sentiment Index was more straightforward and even provided some support for the bears, but all traders currently understand that the dollar's future doesn't hinge on secondary indicators.

Today, Christine Lagarde and Jerome Powell are scheduled to speak. On Friday, we expect the Nonfarm Payrolls and unemployment data. Between Monday and Friday, a series of reports will be released, which are far more significant than the Consumer Sentiment Index. Therefore, we anticipate a very interesting week, and by its end, we'll have a clearer picture of whether the decline in the U.S. labor market has halted and what decision the FOMC might make at its next meeting.

On the 4-hour chart, the pair reversed in favor of the U.S. dollar after a series of bearish divergences appeared in the RSI and CCI indicators, but the downward movement didn't materialize. The RSI also entered the overbought zone a few weeks ago, and currently, another bearish divergence has emerged on the CCI indicator. Given the strength and momentum of the bulls, it's hard to anticipate a significant fall in the euro at this time. Consolidating below the 1.1139 level would suggest a move toward the 1.1013 level, but on the hourly chart, the bears haven't managed to break through the nearest support zone.

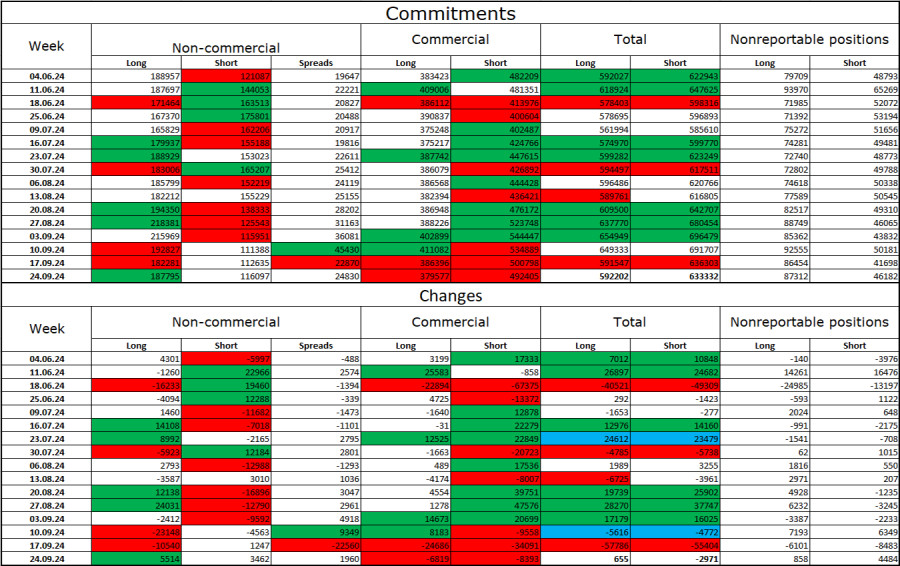

Commitments of Traders (COT) Report:

In the latest reporting week, speculators opened 5,514 long positions and 3,462 short positions. The sentiment of the non-commercial group turned bearish several months ago, but currently, the bulls are once again actively dominating. The total number of long positions held by speculators now stands at 188,000, compared to 116,000 short positions.

However, for the third consecutive week, major players have been reducing their holdings in the European currency. In my view, this could signal the start of a new bearish trend or at least a correction. The key factor in the dollar's recent decline—the expectation of FOMC monetary policy easing—has already been priced in, and the dollar currently has no further reasons to decline. These factors might emerge over time, but for now, the growth of the U.S. currency seems more likely. Active selling of the euro hasn't started yet. If it does, the probability of a bearish trend will increase.

News Calendar for the U.S. and Eurozone:

- Eurozone – Germany's Consumer Price Index (12:00 UTC)

- Eurozone – ECB President Christine Lagarde's speech (13:00 UTC)

- U.S. – Fed Chair Jerome Powell's speech (17:55 UTC)

The economic calendar for September 30 contains several important events, particularly Jerome Powell's speech. The influence of this news backdrop on trader sentiment today could be strong.

EUR/USD Forecast and Trading Tips:

Selling the pair is possible upon closing below the 1.1139 level on the 4-hour chart, with targets at 1.1081 and 1.1070. I would not consider buying the pair now, as it is very likely trading in a sideways range.

Fibonacci levels were plotted from 1.0917 to 1.0668 on the hourly chart and from 1.1139 to 1.0603 on the 4-hour chart.