Some characteristics of digital currencies are unique to them and do not generally apply to other types of assets. One such characteristic is the high volatility of cryptocurrencies, which entails significant fluctuations in their value even within short periods of time.

This volatility is not considered a drawback as it provides traders and investors with additional earning opportunities. For traders, every price fluctuation is an opportunity to make a profitable trade, while for investors, it is a chance to buy and later sell coins at the most advantageous price.

For more information on other characteristics of digital currencies, their emergence, and circulation, see the article "New cryptocurrencies." There you can also find information about the most promising crypto projects at the moment.

Key features of cryptocurrencies

Digital currencies differ from any other currencies, including electronic money, in that they have no physical form. However, this is not the only feature that sets them apart from other assets. Let's take a closer look at the key characteristics of cryptocurrencies:

- Decentralization: Digital currencies are not regulated by any state or government body. This applies to both their issuance and their circulation in the market.

- Transaction anonymity: All transactions with cryptocurrencies are anonymous. Only the wallet address is required to transfer coins, and no personal data is needed.

- Irreversibility: All operations with digital coins are irreversible. Once transactions are recorded on the blockchain, they cannot be altered or canceled. The records remain there forever.

- Resilience to inflation: Since cryptocurrencies are not regulated by any central authority, no one can issue more units to adjust the price. The value is determined solely by supply and demand.

- Security: The use of blockchain technology ensures high reliability in cryptocurrency transactions. Throughout its existence, no one has managed to hack a blockchain due to its unique encryption technology.

- Accessibility: Any user with Internet access can enter the cryptocurrency market, which operates 24/7 with no weekends or holidays.

- Capitalization: The cryptocurrency market is growing daily, with an increasing number of currencies and transactions. Its capitalization has exceeded several trillion dollars in recent years.

- Volatility: One of the main characteristics of cryptocurrencies is variability in their value. Since their exchange rate is not tied to any physical assets, it can change frequently, even within short periods of time.

What is volatility?

Before identifying the most volatile cryptocurrencies, let's take a closer look at what volatility is, how it is measured, and why it occurs in digital currencies.

The term "volatility" means variability or instability. In the context of financial markets, it describes assets whose prices are unstable and fluctuate over a period of time.

Volatility refers to the range of price changes for an asset over a selected period of time. This characteristic can apply not only to digital currencies but also to any other assets.

However, it is more relevant to cryptocurrencies, whose prices can fluctuate by tens or even hundreds of percent within a single trading session. This feature makes it challenging to predict future price movements of coins.

Without volatility, however, trading would lose its purpose. The difference between the buying and selling price of an asset generates profit for traders. By properly analyzing the market and making accurate predictions, every price movement can be used to generate income.

There are two main types of volatility:

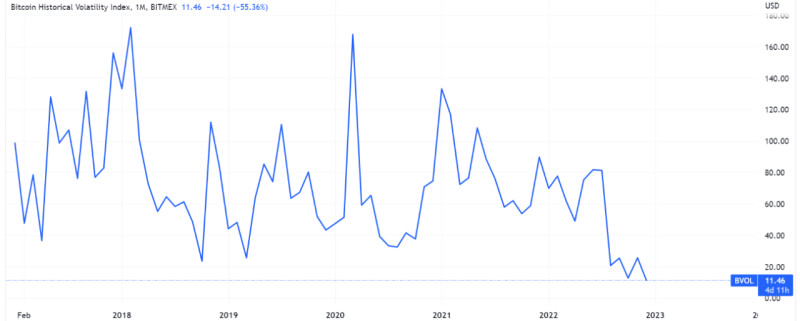

- Actual (historical): This is the actual change in the asset's price over a past period of time.

- Potential (expected): This is the forecasted price fluctuation calculated based on historical volatility data. Traders use this measure to find the most profitable trading opportunities.

The relationship between volatility and liquidity can be illustrated in the table below (as a general rule):

| Liquidity | Volatility |

| Higher | Lower |

| Lower | Higher |

High volatility can be compared to riding a roller coaster with significant ups and steep downs. Low volatility, on the other hand, resembles a calm river cruise, steady and slow with few surprises.

How to measure volatility

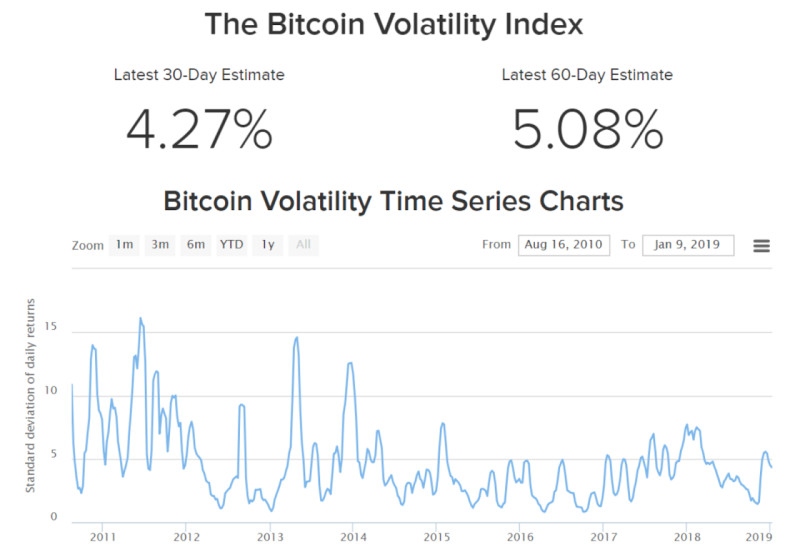

Volatility is often measured using statistical indicators that analyze historical price changes. The most common of these indicators is the standard deviation, which determines how much the range of prices deviates from its average value.

This indicator is usually calculated automatically and can be found on the asset's description page. Also, it can be calculated manually by following these steps:

- Select a time period: For example, you might want to calculate the price changes of a particular digital coin over 10 days.

- Calculate the daily volatility: Divide the opening price by the closing price, subtract one, and multiply the result by 100 to get the percentage.

- Daily calculation: Repeat this calculation for each of the ten days.

- Calculate the average: Sum all the values obtained and divide by the number of days (10 in this example). Multiply the result by 100 to get the percentage.

To determine whether the calculated volatility is low or high, it needs to be compared. You can compare the volatility of several digital currencies or analyze the volatility of one currency over different time periods, such as comparing the current year's data to the previous year's data.

There is also a specific volatility index known as VIX, or the fear index. It reflects the expected level of price fluctuations as perceived by investors, essentially measuring market sentiment. A high VIX reading indicates significant price fluctuations, while a low reading indicates minimal changes.

Volatility is a key factor in assessing risk for investors. The greater the deviation of an asset's price from the average, the higher the risk and the more difficult it is to predict future price movements. Conversely, smaller fluctuations indicate a more reliable and predictable asset.

Why are cryptocurrencies so volatile?

When discussing the most volatile cryptocurrencies, it is important to understand the factors contributing to their high volatility. Here are several key factors that determine the volatility of digital currencies:

- Lack of government regulation: Since the cryptocurrency market is not regulated by any state or government body, there is no mechanism to stabilize digital currency prices. They are determined solely by supply and demand.

- Lack of intrinsic value: Cryptocurrencies are not backed by commodities, precious metals, or raw materials and rely solely on the trust of users. There is also no way to determine their true value.

- Limited supply: Most coins have a predetermined maximum number of units that will be put into circulation. This number cannot be increased, although developers sometimes attempt to artificially regulate supply through mechanisms such as coin burning.

- Market immaturity: The cryptocurrency market is still relatively young and attracts many inexperienced users. These users often make impulsive trades, leading to significant price fluctuations.

- Lack of liquidity: This factor affects less popular currencies. There may be an insufficient number of sellers and buyers, so even small transactions can have a significant impact on the price.

- Speculative nature: Cryptocurrency transactions are generally speculative, with traders trying to profit from any price changes. This speculative trading results in frequent price fluctuations.

- Regulatory news: The introduction of new legislative norms that directly or indirectly affect the status of digital currencies, or even rumors of such changes, can lead to significant price swings.

- Technological improvements: The introduction of new technologies that enhance blockchain technology or the emergence of new digital currencies can disrupt the market and cause sharp price movements.

Volatility: advantage or disadvantage?

We have already discussed what volatility is and how to measure it. Before we dive into which cryptocurrencies are the most volatile, let's examine whether volatility is an advantage or a disadvantage.

On one hand, high volatility is a disadvantage because it makes it difficult to predict an asset's future behavior. In the midst of significant fluctuations, it is quite challenging to analyze historical price changes and make predictions about future behavior.

On the other hand, wild price swings open up many opportunities. For investors, it offers the chance to buy crypto assets at their lowest prices and wait for them to rise. Moreover, short-term fluctuations do not significantly affect long-term investments.

However, it is important to understand that the risks also increase significantly. Poor calculations can lead to investments in assets that will not yield long-term profits. Therefore, when buying the dip, one must be confident that the value of a cryptocurrency will eventually advance.

For traders who profit from making short-term speculative trades, frequent fluctuations are also an advantage. Every price move is an opportunity to make a successful trade. Traders can profit not only from price increases but also from price decreases.

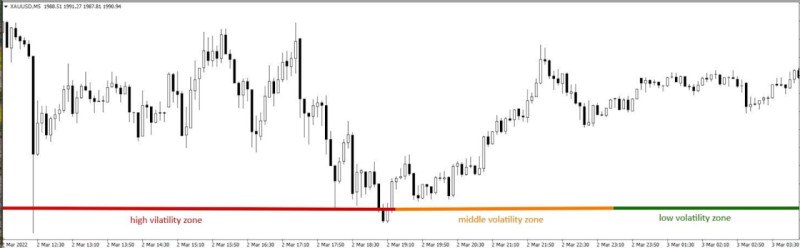

Periods of low volatility are called flat, where the price of an asset moves within a channel bounded by the highest and lowest price levels. In such cases, traders lack good trading opportunities.

However, they can open successful trades if they can correctly identify the moment when the price breaks through the channel boundaries. Entering the market when the price breaks one of the channel boundaries offers the prospect of higher profits than during subsequent directional movements.

Most volatile cryptocurrencies

While we have mentioned that high volatility is characteristic of all digital currencies, there are also various representatives within this category. Some coins are more stable, with prices fluctuating by a few or tens of percent, while others can rise and fall by hundreds or even thousands of percent.

Several categories of cryptocurrencies are particularly prone to significant price fluctuations. These include:

- New projects just entering the market

- Meme coins created for fun

- Shitcoins with little value or use

- Coins with low liquidity and capitalization

Note that many of these currencies have very low liquidity, which makes trading difficult and increases risks. Once purchased, it can be challenging for holders of these coins to sell them. Therefore, inexperienced users should be cautious when buying cryptocurrencies with low liquidity and capitalization.

Nevertheless, even leading digital currencies that have been in the market for many years can experience sharp price swings. This is due to various global factors mentioned above. In addition, changes in the value of these coins affect all other cryptocurrencies.

The first and most well-known digital currency, Bitcoin, drives the entire cryptocurrency market. Its rises and falls are followed by the appreciation or depreciation of all other coins. Factors influencing Bitcoin include political events, miner activity, and the actions of large market players known as whales.

The second most popular cryptocurrency is Ethereum, which focuses on decentralized finance (DeFi) and smart contracts. Therefore, the main factors affecting its price include changes in the DeFi sector and updates to the Ethereum chain.

Other cryptocurrencies to watch

Continuing our discussion on the most volatile cryptocurrencies, let's highlight a few more examples of such coins. There is a certain pattern: if a digital currency is tied to a specific chain or application, its volatility is directly influenced by news about that platform.

Some cryptocurrency exchanges have issued their own currencies for internal chain use. One example is Binance Coin issued on the Binance Smart Chain platform. This coin becomes particularly volatile during periods of updates to the exchange itself, as well as amid news of regulatory changes affecting exchanges in different countries.

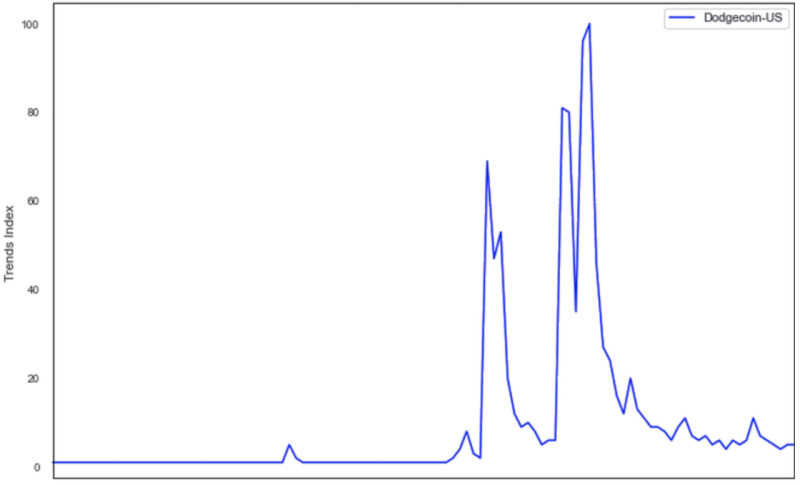

As mentioned above, meme coins are highly volatile because they have no practical function and are created purely for entertainment. Examples of such tokens include Dogecoin and Shiba Inu created based on the meme of the Shiba Inu dog. The popularity of these coins is driven by social media hype.

Since meme coins have no practical purpose, their prices can fluctuate significantly under various influences. Often, a mention by a media personality with authority in the industry can contribute to a spike in their value.

The Ripple project is the third-largest digital currency by market capitalization. Its mission was to bridge the gap between fiat and cryptocurrency markets. The volatility of this coin largely depends on regulatory news and platform partnerships.

Another similar project is Stellar, which was created to enable the operation of all types of money within a single platform. This payment network allows transactions with two different currencies simultaneously. However, the exchange rates of other currencies may affect the price of the token on this platform.

How to find volatile cryptocurrencies

As noted before, the most volatile cryptocurrencies are of particular interest to traders who profit from making numerous short-term trades. For them, every price fluctuation is an opportunity to make money.

Therefore, wild price swings are not only acceptable but even desirable. Traders specifically look for and choose assets that are capable of showing significant price changes. Let's find out where and how to find such cryptocurrencies and identify periods of highest volatility.

Price fluctuations alone do not make a currency volatile. To find volatile crypto assets, one must consider several factors. Price changes can help filter out currencies, but one should also pay attention to liquidity, trading volumes, and market capitalization.

Why are these factors important? This is due to the fact that for more liquid coins with high capitalization, a price shift of 5-10% is already considered highly volatile as they are difficult to move. In contrast, for less liquid and popular altcoins, such shifts would be nearly imperceptible.

To assess the dynamics and find highly volatile instruments, one can analyze statistical data on exchange websites or use special screeners.

Each exchange website has a market statistics section that contains key information about trading instruments. To find crypto assets with the most significant price changes, sort the relevant section. Thus, coins that have experienced the largest increase or decrease in value over a day will appear at the top of the list.

Screeners differ in that they aggregate and combine data from multiple exchanges in one place. These websites allow you to sort information by various metrics and highlight the leaders in price rallies and declines over a selected period of time.

Conclusion

In this article, we have discussed the concept and causes of cryptocurrency volatility, as well as the most volatile cryptocurrencies. Sharp price swings are one of the key characteristics of digital coins as crypto exhibits the highest volatility among all other assets.

This is due to a number of reasons, including the lack of government regulation, the immature nature of the cryptocurrency market, the speculative nature of the assets, and many others. However, for traders and investors, high volatility is more of an advantage than a disadvantage.

For traders, any price movement can lead to a highly successful trade. They can earn money not only on price increases but also on decreases in the value of digital coins. For investors, it is an opportunity to buy assets at a lower price and later sell them at a higher price.

The most volatile cryptocurrencies tend to be those just entering the market, as well as meme coins and shitcoins, which serve no practical purpose and are created solely for entertainment. There is also a correlation between liquidity and volatility: the higher the liquidity, the lower the volatility, and vice versa.

The most volatile assets can be found using cryptocurrency exchanges or special screening websites. They aggregate information from multiple exchanges, making them convenient to use. Simply filter coins by the parameter "price change" or "volatility" to get assets with the most significant price fluctuations.

Back to articles

Back to articles