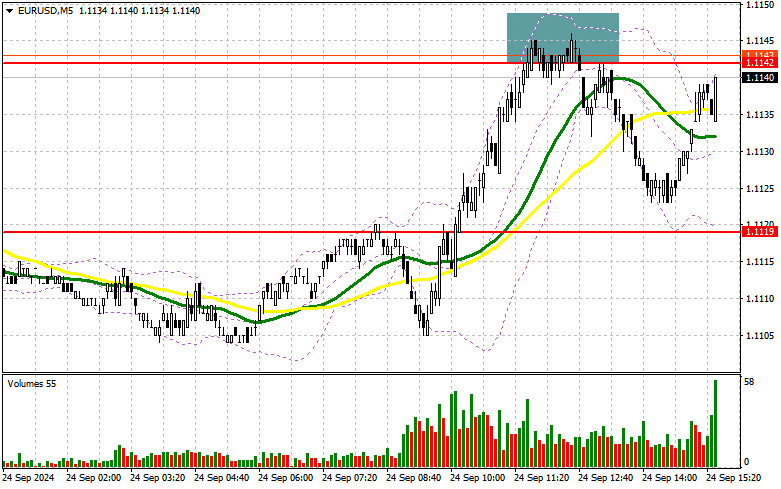

In my morning forecast, I focused on the level of 1.1142 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. The rise to the 1.1142 level and the formation of a false breakout there led to an excellent entry point for selling the euro, resulting in the pair declining by more than 25 points. The technical outlook remained unchanged for the second half of the day.

For Opening Long Positions on EUR/USD:

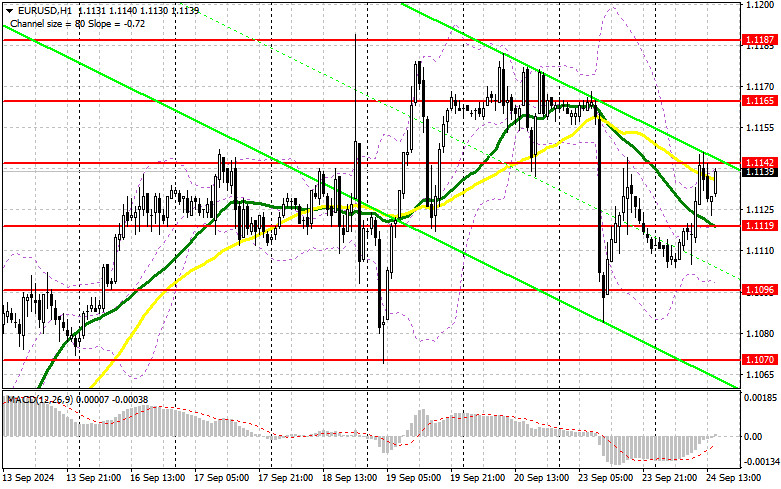

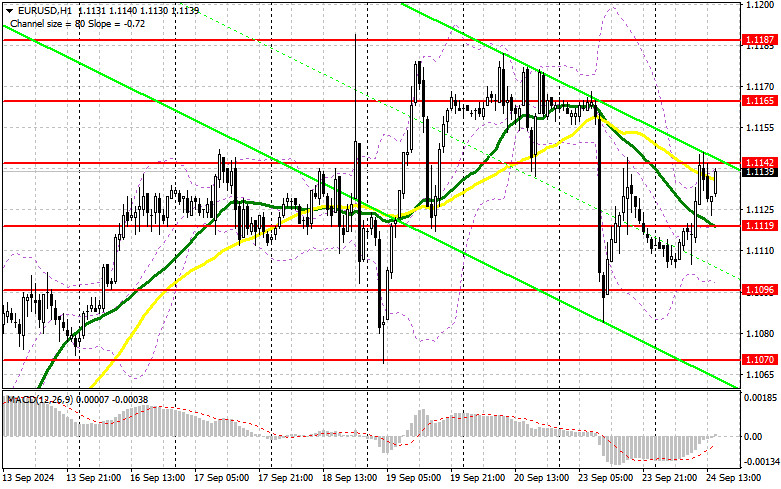

Weak data from Germany limited the euro's growth in the first half of the day and prevented it from breaking above the resistance at 1.1142. However, as you can see on the chart, buyers are still trying to take this level. Weak U.S. consumer confidence data and poor housing market reports will likely help. Furthermore, the Richmond Fed Manufacturing Index is due, followed by a speech from FOMC member Michelle Bowman. If the reports exceed expectations, I will take action on a decline near the support level of 1.1119, which acted as resistance this morning. The target will be the 1.1142 level, which has been difficult to breach. A breakout and retest of this range from the top down will lead to a rise in the pair, providing a chance to test 1.1165. The farthest target will be the 1.1187 high, where I plan to take profit. In the case of a drop in EUR/USD and no activity around 1.1119 in the second half of the day, pressure on the pair will return, leading to a larger sell-off. In this scenario, I will only enter after forming a false breakout near the next support at 1.1096. I plan to open long positions on the rebound from 1.1070 with a target of a 30-35 point upward correction during the day.

For Opening Short Positions on EUR/USD:

Sellers have an opportunity to drive the euro lower, but strong U.S. data and another defense of the 1.1142 level are needed. Only a false breakout formation at that level, similar to the one discussed earlier, would provide a good opportunity to open short positions and target the support area of 1.1119, where the moving averages, which favor the bulls, are located. A breakout and consolidation below this range, followed by a retest from bottom to top, will provide another selling opportunity targeting the 1.1096 level, where I expect larger euro buyers to emerge. The furthest target will be the 1.1070 level, which will completely negate the bulls' plans for further growth. That's where I'll take profit. In the case of an upward movement in EUR/USD and no bearish activity around 1.1142, the bulls will gain strength and aim for last week's highs. In such a scenario, I will postpone selling until the next resistance at 1.1165. I will also sell there, but only after a failed consolidation attempt. I plan to open short positions on a rebound from 1.1187 with a target of a 30-35 point downward correction.

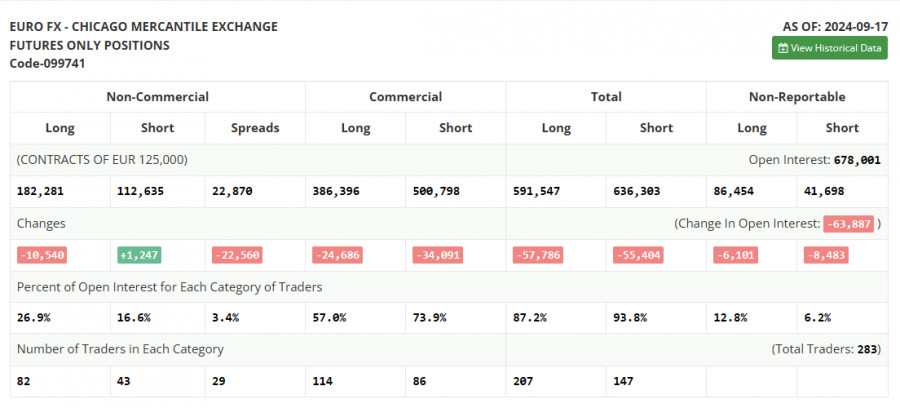

In the COT (Commitment of Traders) report from September 17, there was a decrease in long positions and a slight increase in short positions. The Federal Reserve's decision to cut rates by 0.5% was quite unexpected, but traders did not significantly revise their positions, favoring the strengthening of the European currency over the U.S. dollar. In the near future, we will only have speeches from several representatives of the Fed and the European Central Bank without any important fundamental statistics, so market volatility may decrease. However, this does not cancel the medium-term upward trend for the euro, and the lower the pair goes, the more attractive it becomes for buying. The COT report indicated that long non-commercial positions decreased by 10,540 to 182,281, while short non-commercial positions increased by 1,247 to 112,635. As a result, the gap between long and short positions narrowed by 20,560.

Indicator Signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating further growth of the euro.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In the case of a decline, the lower boundary of the indicator around 1.1096 will serve as support.

Description of Indicators:

- Moving average: A tool used to identify the current trend by smoothing out volatility and noise. Period 50 is marked in yellow on the chart.

- Moving average: Another moving average to identify trends, with a period of 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions held by non-commercial traders.