Prices for dairy products fell by 8.5% over the past two weeks, which turned out to be significantly worse than forecasts of a 0.3% price drop after a decline of 3.6%, 1.0%, and 0.9% in previous reporting periods. Against the background of the general rise in commodity prices, this is a bad sign for the New Zealand currency. A significant part of New Zealand's exports is dairy products – primarily milk powder, which accounts for about 20% of total exports. The decline in world prices for dairy products has a negative impact on the NZD, reducing the volume of foreign currency export earnings to the country's budget.

Also on Tuesday (at 22:45 GMT), Statistics New Zealand reported an acceleration in wage growth in New Zealand in the 1st quarter. Wages in the private sector increased by 3.1% (in annual terms) after an increase of 2.8% in the 4th quarter, while still continuing to lag far behind inflation.

The unemployment rate, according to the published report, remained unchanged at 3.2%, while the overall employment rate in the country increased by 0.1% in the 1st quarter.

These positive data from the New Zealand labor market slightly comforted buyers of the New Zealand currency, as they reinforced the market's opinion that the Reserve Bank of New Zealand will raise the key interest rate by 50 basis points at its meeting later this month. In April, the RBNZ decided to raise the key interest rate by 0.50% (to 1.50%), also accelerating the curtailment of monetary stimulus after inflation jumped to a multi-year high. It was the fourth consecutive rate hike by the Reserve Bank of New Zealand after a 25 basis point hike at each meeting in October, November, and February.

"Moving the OCR to a more neutral stance sooner will reduce the risks of rising inflation expectations," the RBNZ said.

However, economists say an accelerated RBNZ tightening cycle also risks a sharp slowdown in the economy, which is already facing headwinds from weak corporate and consumer confidence, China's quarantine policy, and Russia's military sting operation in Ukraine.

Despite the increase in interest rates, the New Zealand dollar failed to strengthen after the last meeting of the RBNZ. The entire previous month, the New Zealand currency continued to actively weaken, including in cross-pairs, for example, in the AUD/NZD pair.

The Australian central bank also raised interest rates this week for the first time since November 2010. The rate was raised by 0.25% to 0.35%, which also exceeded the forecast of an increase of 0.15%. In addition, the RBA signaled the likelihood of a further increase in the coming months.

Although both central banks, New Zealand and Australia, are now pursuing tighter monetary policies, the outlook for the Australian dollar looks more attractive than that of the New Zealand dollar. In addition, the situation with the acceleration of inflation in New Zealand is somewhat worse than in Australia.

Consumer prices in New Zealand jumped 5.9% (on an annual basis) at the end of last year, accelerating from 4.9% in the previous quarter. The country's central bank aims to keep inflation in the range of 1.0% to 3.0% in medium-term.

In Australia, total annual consumer price inflation in Q1 was 5.1%, while core inflation was 3.7%. Now market participants take into account in prices the increase in the RBA interest rate to 2.5% by the end of this year, and the RBA has more room for maneuver in this process than the RBNZ: now the interest rate level in the RBA and RBNZ is 0.35% and 1.5%, respectively.

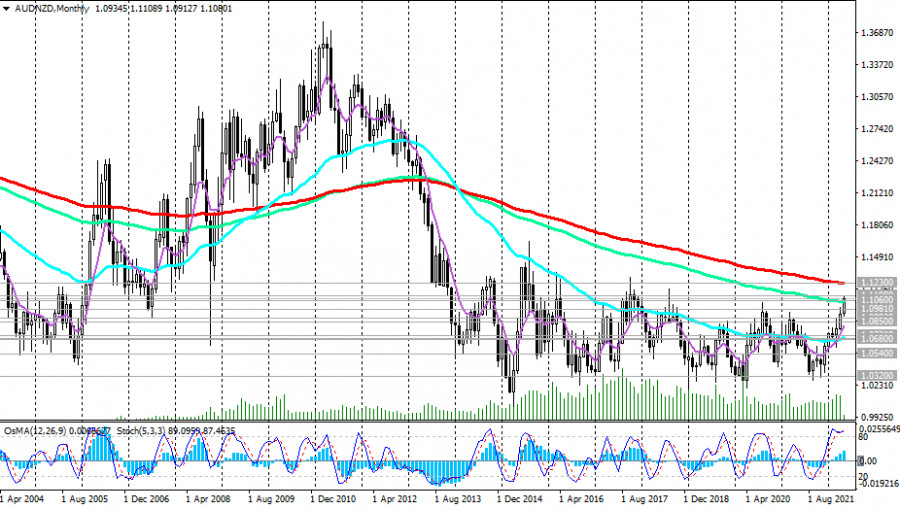

The AUD/NZD pair broke through an important resistance level near 1.0540 in mid-December and continued to grow actively, reaching a local 3.5-year high of 1.1108 this week. At the moment, the pair is testing an important resistance level of 1.1060 for a breakdown.

Consolidation in the zone above the resistance level of 1.1230 will create prerequisites for this pair to enter the global bull market zone.

In tomorrow's news regarding the AUD and the AUD/NZD pair, it is worth paying attention to the publication at 01:30 (GMT) of the RBA's monetary policy commentary, which provides an overview of economic and financial conditions and assesses risks to financial stability and sustainable economic growth. The commentary is, in a way, a guideline for determining the RBA's monetary policy plans. A tighter stance on the monetary policy of the RBA is viewed as positive and strengthens the Australian dollar, while a more cautious stance is assessed as negative for the AUD.