After a minimal upward retracement, the GBP/USD currency pair sustained a downward movement on Wednesday. These retracements are so minor that they are hardly noticeable on the charts. The British pound continues to decline for the same reason the euro is currently falling. What did those market participants who supported the pound's rise throughout 2024 expect? For it to keep rising forever? Throughout this year, we consistently pointed out that the dollar was oversold and unjustifiably cheap. The entire two-year rally of the British currency was merely a correction within a 16-year downward trend. Of course, it will end someday, but it's still too early to say that has happened. Therefore, the pound has exceeded its corrective movement's potential. The only reason for the British currency's rise was the Federal Reserve's monetary policy, as the market waited for its easing for two years. It simply ignored all other factors.

It even reached the point of absurdity, where experts and various statistical bureaus, along with major banks, deliberately inflated forecasts for key U.S. reports, like Non-Farm Payrolls or unemployment rates. If the Fed adheres to a tight monetary policy, what should happen to the labor market? Especially when Fed representatives demand cooling to lower inflation? The labor market should show a decline in indicators, and unemployment should rise. So why did we continually see forecasts for these two indicators predicting growth in the past six months? How can you expect growth when the Fed is explicitly working to reduce these figures? Naturally, with each report, the market was "disappointed" and eagerly sold off the U.S. dollar again—pure manipulation.

This week, there will be one or two speeches by the Bank of England's Governor, Andrew Bailey. However, this is unlikely to be a "lifeline" for the pound. We can only expect a softer stance from the BoE, as inflation has dropped just as sharply as in the Eurozone, where the European Central Bank has already lowered rates three times. The BoE has cut rates just once and is still waiting for conditions to improve—specifically, for a slowdown in service sector inflation and core inflation.

Let's also look separately at the U.S. and UK economies. The American economy is thriving and shows no signs of slowing down. The British economy, on the other hand, has not grown for two years. Nevertheless, many experts labeled the minimal growth of the British economy as "recovery in tough conditions" while dismissing American growth as "meaningless since a recession will start anyway." Yet here we are at the end of the year, and a recession in the U.S. economy has not begun. Thus, the market initially misjudged the state of these economies, and now it has no choice but to correct its own mistakes. Therefore, we fully support the continued decline of the British pound.

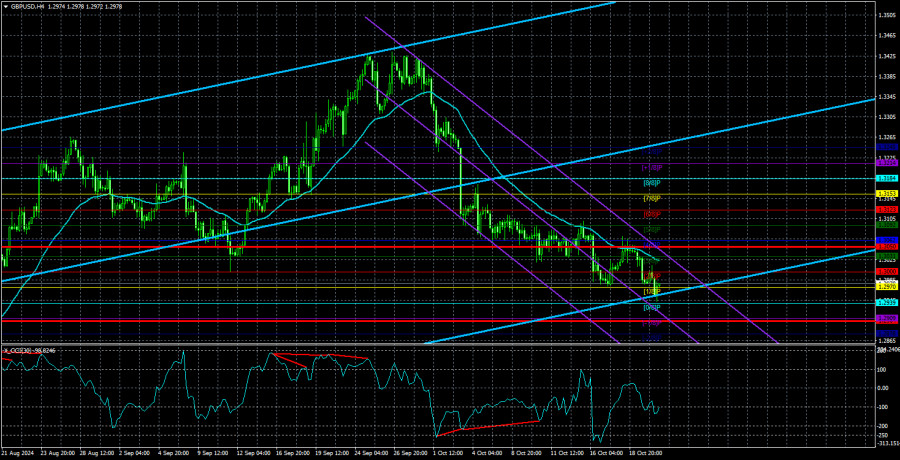

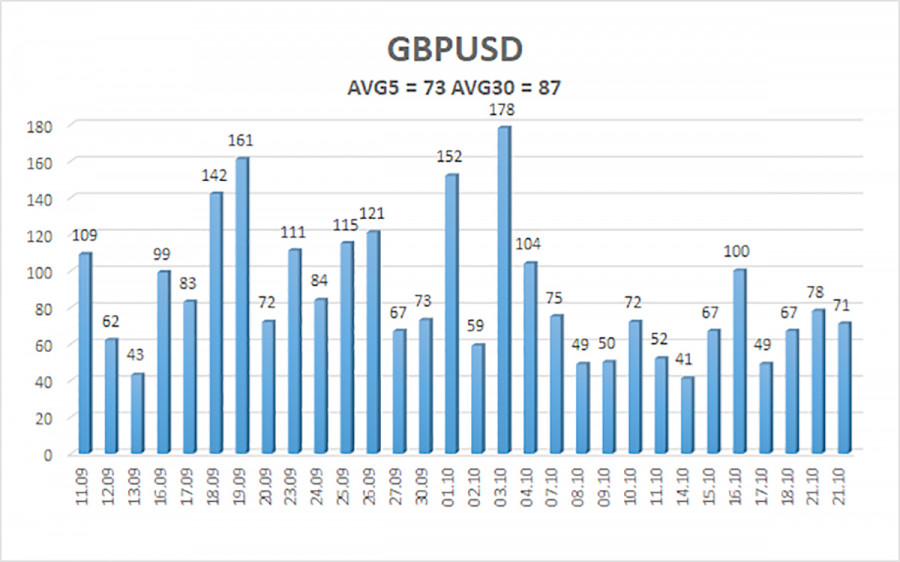

The average volatility of the GBP/USD pair over the last five trading days is 71 pips, considered "average" for the pound/dollar pair. On Thursday, October 24, we expect the pair to move within a range limited by the levels of 1.2990 and 1.2848. The higher linear regression channel points upward, indicating that the upward trend persists. The CCI indicator formed six bearish divergences before the decline began. Recently, the indicator entered the oversold area and formed several bullish divergences, suggesting an upward correction may be brewing.

Nearest Support Levels:

Nearest Resistance Levels:

- R1 – 1.2939

- R2 – 1.2970

- R3 – 1.3000

Trading Recommendations:

The GBP/USD currency pair maintains its downward trend. We still do not consider long positions, as we believe that all the factors for the British currency's growth have already been fully priced in by the market several times. Suppose you trade based on "pure" technicals; long positions could be considered with targets at 1.3092 and 1.3123 if the price is above the moving average line. Short positions are much more relevant now, with targets at 1.2878 and 1.2848. However, consolidation above the moving average would likely signal a correction, which could take quite some time.

Illustration Notes:

Linear Regression Channels: help determine the current trend. If both are directed the same way, the trend is strong.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the likely price range the pair will trade in the next 24 hours, based on current volatility readings.

CCI Indicator: entering the oversold area (below -250) or the overbought area (above +250) signals that a trend reversal in the opposite direction is near.