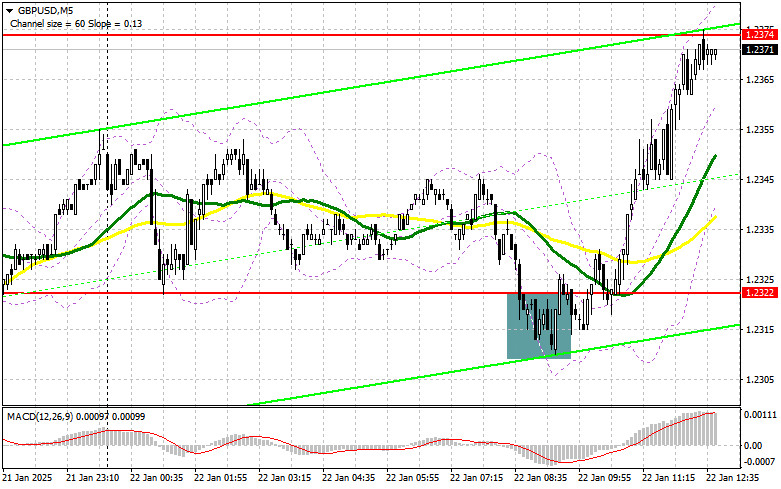

In my morning forecast, I highlighted the 1.2322 level and planned to make market entry decisions around it. Let's review the 5-minute chart and analyze what happened. The decline and formation of a false breakout near 1.2322 led to a buying opportunity for the pound, ultimately resulting in its rise toward the target level of 1.2374, delivering over 50 points in profit. The technical outlook for the second half of the day has been revised.

To Open Long Positions on GBP/USD

A significant increase in UK public sector borrowing and optimism surrounding Trump's measured approach in the first days of his presidency continue to support the pound and pressure the US dollar. In the afternoon, only data on the US Leading Indicators Index is scheduled, which could spark a new wave of pound growth.

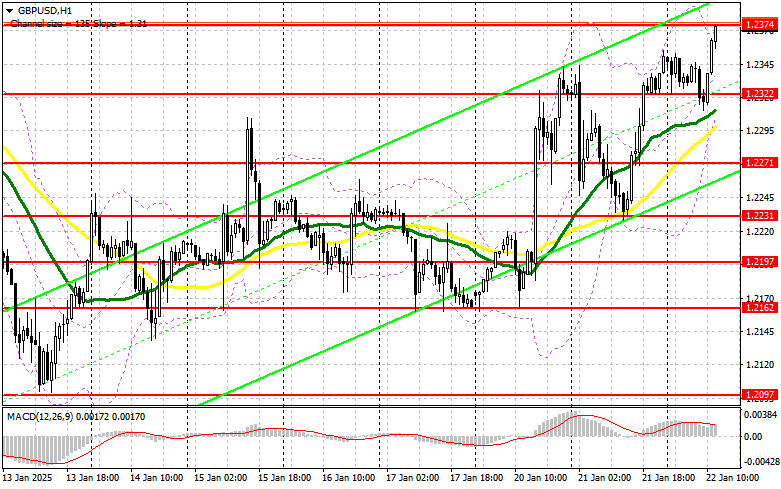

If the pair declines, I plan to buy only after forming a false breakout near the nearest support at 1.2322, similar to the earlier scenario. The target will be a recovery of GBP/USD toward the 1.2374 resistance level. A breakout and retest from above of this range would create a new entry point for long positions, aiming for a move to 1.2412, which would further solidify the bullish trend. The ultimate target will be the 1.2449 level, where I will lock in profits. If GBP/USD declines and shows no bullish activity at 1.2322, the pound could erase its morning gains. In this case, only a false breakout near the 1.2271 level would provide an appropriate condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.2231, targeting an intraday correction of 30–35 points.

To Open Short Positions on GBP/USD

Sellers made attempts during the first half of the day, but with limited success. Now it is crucial to maintain control of the nearest resistance at 1.2374, which has already been tested. The lack of active downward movement from this level is concerning.

Only forming a false breakout at 1.2374 after US data could create a selling opportunity, aiming for a drop toward 1.2322, below which the moving averages favor bulls. A breakout and retest from below of this range would trigger stop-loss orders, opening the path to 1.2271, signaling the halting of the bullish market. The ultimate target will be the 1.2231 level, where I plan to lock in profits. If demand for the pound persists in the second half of the day and bears fail to act at 1.2374, it's better to postpone short positions until testing the 1.2412 resistance. I'll only sell there after a failed consolidation. If no downward movement occurs there, I'll look for short positions on a rebound from 1.2449, targeting an intraday correction of 30–35 points.

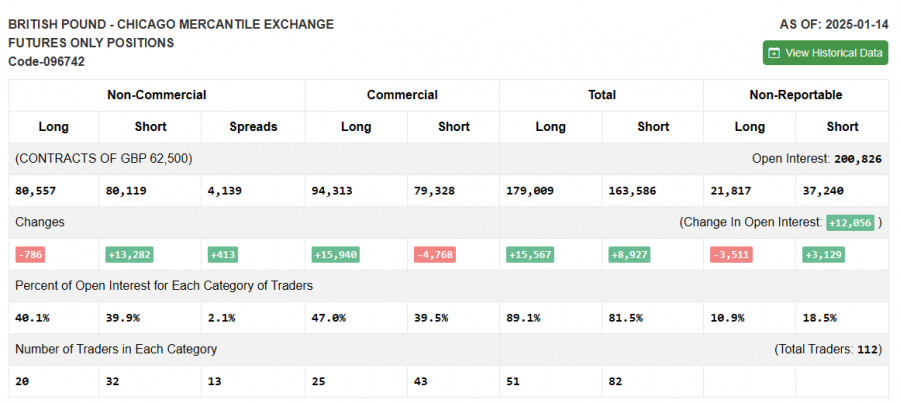

Commitment of Traders (COT) Report

The January 14 COT report indicated a sharp increase in short positions and a reduction in long positions. The balance of power has shifted significantly, signaling a market at a turning point. With nearly equal numbers of buyers and sellers, the outlook is not in favor of bulls. In the near future, labor market data is expected, and following weak UK GDP growth and high inflation, the Bank of England's next decision seems less predictable. Whether the regulator will lower interest rates amidst the observed issues remains a complex question. The latest COT report noted that long non-commercial positions fell by 786 to 80,557, while short non-commercial positions increased by 13,282 to 80,119, resulting in the gap between long and short positions widening by 413.

Indicator Signals

Moving AveragesTrading occurs above the 30- and 50-day moving averages, indicating further growth for the pair.Note: The author analyzes the moving averages on the hourly H1 chart, differing from the classical definition on the daily D1 chart.

Bollinger BandsIn the event of a decline, the lower boundary of the indicator near 1.2320 will act as support.

Indicator Descriptions

- Moving Average: Determines the current trend by smoothing volatility and noise. Periods: 50 (yellow), 30 (green).

- MACD: Moving Average Convergence/Divergence. Fast EMA – Period: 12, Slow EMA – Period: 26, SMA – Period: 9.

- Bollinger Bands: Tracks price volatility. Period: 20.

- Non-Commercial Traders: Speculators like individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long Non-Commercial Positions: Total long positions held by non-commercial traders.

- Short Non-Commercial Positions: Total short positions held by non-commercial traders.

- Net Non-Commercial Position: The difference between short and long positions held by non-commercial traders.