Analysis of Trades and Tips for Trading the Euro

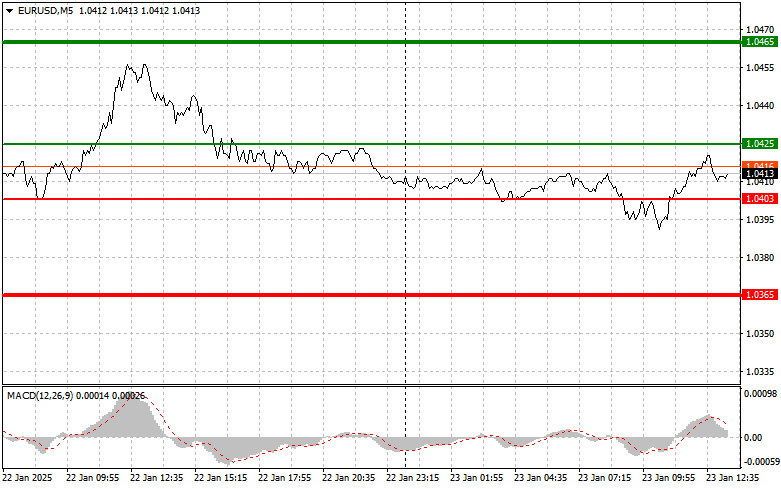

The first test of the 1.0401 level occurred when the MACD indicator had significantly moved below the zero mark, clearly limiting the pair's downward potential. For this reason, I did not sell the euro. Shortly afterward, another test of 1.0401 occurred when the MACD was in the oversold zone, allowing Scenario #2 for buying to be implemented. As a result, the pair rose by 20 points.

At this stage, the technical picture remains uncertain. Despite sellers' activity at 1.0420, they failed to deliver a serious blow to the bulls, creating opportunities for speculative maneuvers on both sides. Short-term investors may start taking profits, while larger players may continue observing developments, waiting for clearer signals to make decisions. It's worth noting that the current situation could lead to price consolidation within a narrow range, where movements will depend on the news backdrop. Today's speech by Trump will provide a strong informational trigger, potentially causing significant market movements. It all depends on what he says.

Additionally, today's US initial jobless claims data will play a role in shaping market direction. A decline in claims would indicate an improvement in the labor market, which could strengthen the dollar. A strong labor market is a crucial factor for the Federal Reserve when deciding on interest rates. If the data shows a further reduction in unemployment claims, it could lead to expectations of a more active approach by the central bank regarding monetary policy. As a result, the dollar could gain support not only from the domestic economy but also from global macroeconomic factors.

Regarding intraday strategies, I will rely on the implementation of Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro if the price reaches 1.0425 (green line on the chart) with the target of rising to 1.0465. At 1.0465, I will exit the market and also sell the euro in the opposite direction, expecting a movement of 30-35 points from the entry point. A rise in the euro today can only be expected with weak US data and new comments from Donald Trump.Important: Before buying, ensure the MACD indicator is above the zero mark and is just starting to rise.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.0403 level, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. Growth can be expected to opposite levels 1.0425 and 1.0465.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.0403 level (red line on the chart). The target will be 1.0365, where I will exit the market and immediately buy in the opposite direction (expecting a movement of 20-25 points in the opposite direction from the level). Selling pressure on the pair could return at any moment.Important: Before selling, ensure the MACD indicator is below the zero mark and is just starting to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.0425 level, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected to opposite levels 1.0403 and 1.0365.

Chart Details:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Suggested price for setting Take Profit or manually fixing profits, as growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Suggested price for setting Take Profit or manually fixing profits, as further declines below this level are unlikely.

- MACD Indicator: When entering the market, it is crucial to monitor overbought and oversold zones.

Important Notes:

Beginner traders in the Forex market must be very cautious when deciding on market entries. Before the release of significant fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, similar to the example presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.