The EUR/USD currency pair remained mostly stagnant throughout Thursday, which was both logical and expected. In the days leading up to this, the pair experienced fluctuations that raised many questions. However, during those days, there was at least some macroeconomic context—although it wasn't always entirely logical—that could explain those changes. On Thursday, though, the macroeconomic backdrop was nearly nonexistent, which accounts for the lack of significant movements. It's important to note that the absence of news doesn't always result in market inactivity. However, when these factors coincide, the outcomes tend to be understandable.

From a technical perspective, the situation of the euro has not changed, even after recent erratic movements. We have witnessed another corrective phase within the long-standing downtrend, which resumed shortly afterward. The price remains below the moving average line. Traders had hoped that the eurozone inflation report would exceed forecasts for December; however, inflation did not rise as anticipated, leading to a decline in expectations for a less dovish stance from the European Central Bank (ECB). As a result, the euro has once again fallen sharply.

Thus, as previously mentioned, there have been no changes—neither technically nor fundamentally. Given this context, further declines in the euro towards the 1.00-1.02 range, extensively discussed last year, seem likely. The arrival of Donald Trump in office, scheduled for January 20, may cause a slight shift in market sentiment towards the dollar and euro, but this remains speculative at this stage. Currently, there are no clear reasons to believe that Trump's presidency would alter the dynamics for the euro or the dollar. It's essential to remember that the Federal Reserve's monetary policy is the primary driver of the euro's decline and the dollar's strength. Markets had anticipated "ultra-dovish" actions from the Fed in 2024-2025, but these did not materialize. Since these expectations had been priced in as early as fall 2022, a "course correction" to align with fair value was inevitable. As of now, nothing has changed in this regard.

The euro has been affected by a 16-year-long global downtrend. Given this context, any rise in the euro, beyond a corrective rebound, seems unlikely. Last year, we highlighted that the euro reached record levels of overvaluation when considering the existing fundamental and macroeconomic factors. Such a situation could not last indefinitely. Therefore, we continue to anticipate further declines in the euro. While there may be some short-term growth in the pair—observable on the daily timeframe—it would still represent only a corrective phase for the euro.

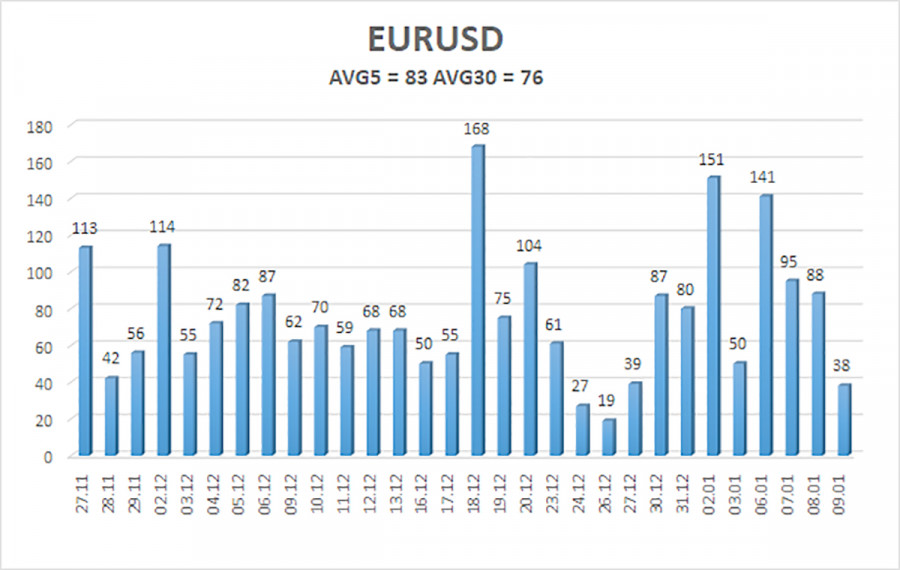

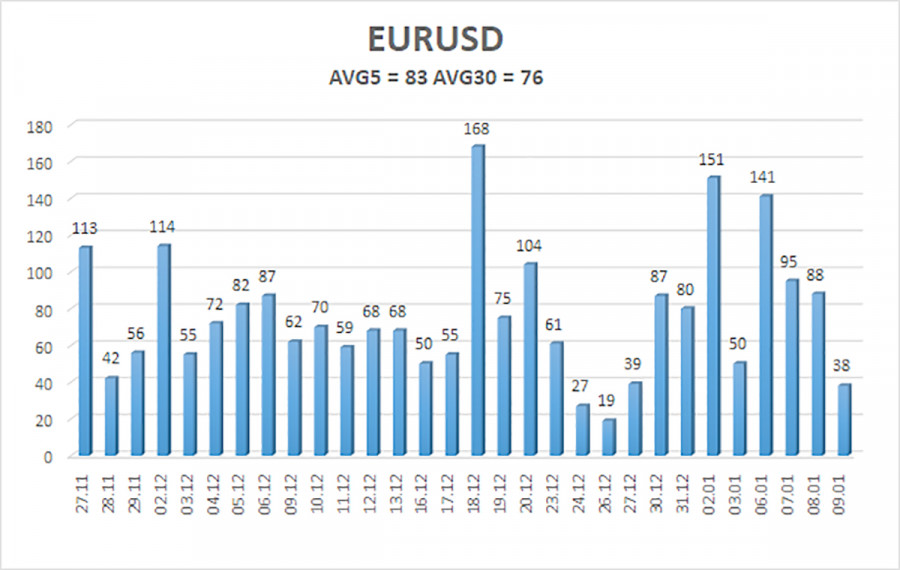

As of January 10, the average volatility of the EUR/USD currency pair over the past five trading days is 83 pips, which is considered "medium." We anticipate that the pair will fluctuate between the levels of 1.0218 and 1.0384 on Friday. The upper linear regression channel remains downward, reinforcing the overall bearish trend. The CCI indicator has entered the oversold zone twice, resulting in the formation of a new bullish divergence. However, this signal indicates only a correction, which has already taken place.

Nearest Support Levels:

- S1 – 1.0254

- S2 – 1.0193

- S3 – 1.0132

Nearest Resistance Levels:

- R1 – 1.0315

- R2 – 1.0376

- R3 – 1.0437

Trading Recommendations:

The EUR/USD pair is likely to continue its downward trend. Over the past few months, we have consistently noted our expectation for a medium-term decline in the euro. We fully support this overall downward direction and do not believe it has reached its conclusion. There is a high likelihood that the market has already factored in all future Federal Reserve rate cuts, which means the dollar currently lacks fundamental reasons for a medium-term decline, aside from potential technical corrections. Short positions remain relevant, with targets set at 1.0254 and 1.0218. For those trading based purely on technical signals, long positions may be considered if the price rises above the moving average, with a target of 1.0437. However, any upward movement at this stage should be viewed as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.