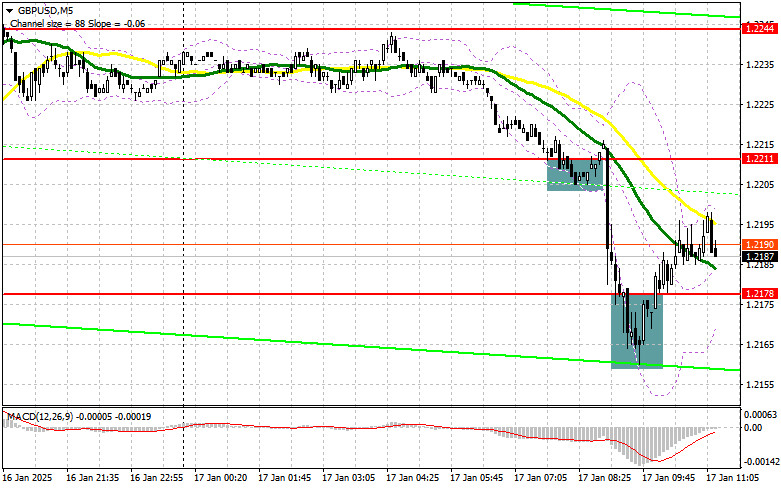

In my morning forecast, I focused on the 1.2178 level as a key point for market entry decisions. Let's analyze the 5-minute chart and see what happened. A decline followed by a false breakout around 1.2178 provided a good entry point for long positions, but so far, this has only resulted in a 20-point rise. However, early buys at the 1.2211 test resulted in losses. The technical picture has been revised for the second half of the day.

To Open Long Positions on GBP/USD:

News of a sharp contraction in retail sales in the UK in December unsurprisingly brought renewed pressure on the British pound, leading to a significant sell-off that breached the key 1.2162 support, which had been a reliable level for bulls in recent days. In the second half of the day, only weak US data on building permits, housing starts, and industrial production can help the pound recover. Otherwise, pressure on the pair will persist, potentially driving it to a new weekly low.

In the event of a decline, I plan to act on a false breakout near the 1.2162 support, as seen earlier. This could lead to a recovery toward the 1.2226 resistance formed during the first half of the day. A breakout and retest of this range from above would create a new buying opportunity, with the next target at 1.2271, easing pressure on buyers. The ultimate goal would be the 1.2303 level, where I plan to lock in profits.

If GBP/USD falls further and bulls fail to defend 1.2162, as seems likely, the pound may drop significantly. In this case, a false breakout near the 1.2097 low would offer a suitable condition for opening long positions. I would consider buying GBP/USD immediately on a rebound from 1.2065, targeting a 30-35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers made considerable progress in the first half of the day, capitalizing on weak UK data. Although pressure on the pound has eased, focus is now on fresh US statistics. In the second half of the day, it's best to confirm bearish interest at the 1.2226 level, which the pair could test in the event of weak US data. A false breakout there would provide a solid entry point for short positions, targeting a decline to the 1.2162 level. A breakout and retest of this range from below would trigger stop-loss orders, opening the way toward 1.2097—a sign of a strengthening bearish market. The ultimate target would be 1.2065, where I plan to lock in profits.

If demand for the pound returns in the second half of the day and bears fail to act near 1.2226, where moving averages are also positioned in their favor, I would delay selling until the 1.2271 resistance test. I will only consider shorts there after a failed consolidation. Alternatively, I would sell on an immediate rebound from 1.2303, targeting a 30-35 point downward correction.

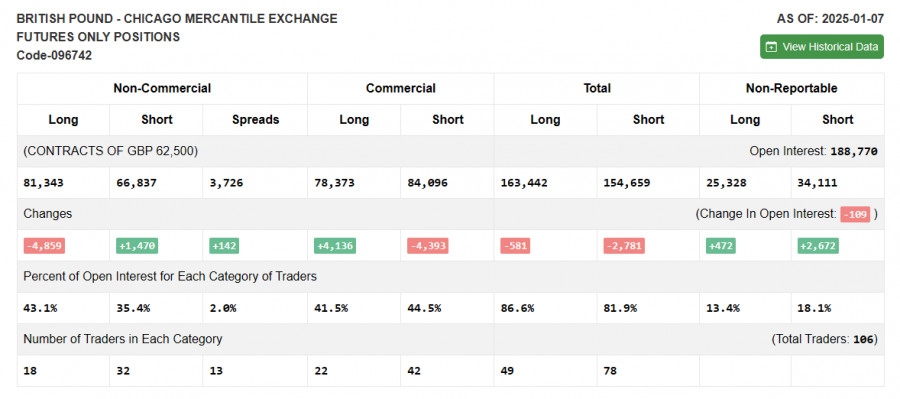

According to the Commitments of Traders (COT) report from January 7, short positions increased while long positions declined. In general, the balance of forces remains largely unchanged, and despite a dominance of bullish positions, the pound continues to weaken against the US dollar. Upcoming data on UK inflation and GDP may complicate the Bank of England's future decisions, limiting the chances of a significant GBP/USD rally. The latest COT report showed that long non-commercial positions decreased by 4,859 to 81,343, while short positions rose by 1,470 to 66,837, increasing the net gap by 142.

Indicator Signals

Moving Averages

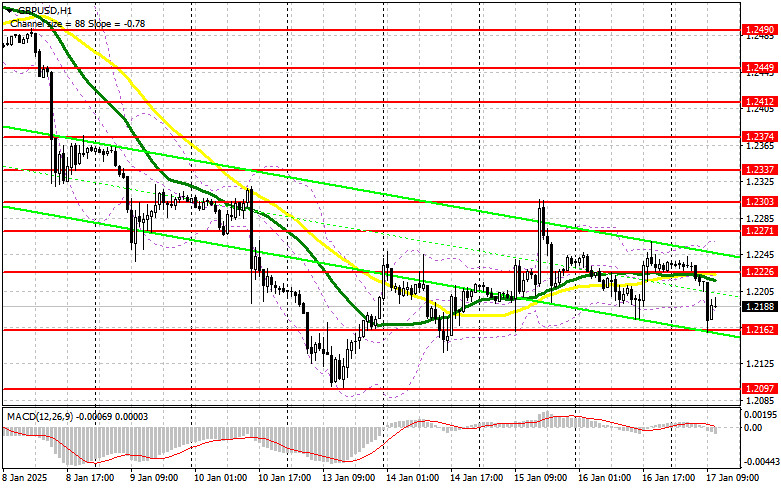

Trading below the 30- and 50-day moving averages, indicating renewed pressure on the British pound.

Note: The moving averages are based on the H1 chart as analyzed by the author, differing from the standard D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator around 1.2196 will act as support.

Indicator Descriptions:

- Moving average (SMA): Smooths price volatility to indicate trends.

- 50-period SMA: Marked in yellow.

- 30-period SMA: Marked in green.

- MACD (Moving Average Convergence Divergence): Measures the convergence/divergence of moving averages.

- Fast EMA: 12-period.

- Slow EMA: 26-period.

- SMA: 9-period.

- Bollinger Bands: Uses a 20-period moving average with standard deviation to measure volatility.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and institutions using futures for speculative purposes.

- Long non-commercial positions: Total long positions held by speculators.

- Short non-commercial positions: Total short positions held by speculators.

- Net non-commercial position: Difference between long and short positions of speculators.