Analysis of Friday's Trades

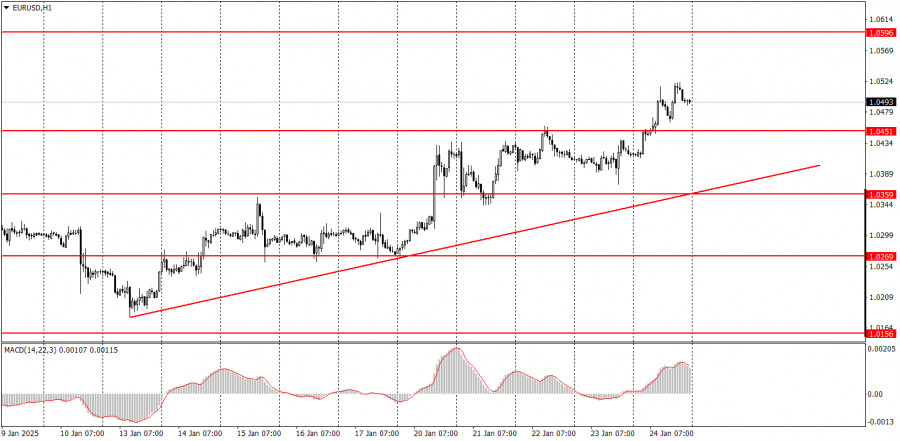

1H Chart of EUR/USD

On Friday, the EUR/USD currency pair continued its upward trend, significantly supported by macroeconomic data. As mentioned previously, activity indices are not the most critical indicators. It's important to note that the upward correction began even without positive data from the Eurozone, indicating that the market is currently favoring an upward movement for the pair. The business activity indices, which did support the euro's strength, simply reinforced the overall market sentiment.

In Germany, both business activity indices exceeded forecasts and prior values. For the Eurozone, the manufacturing sector index surpassed expectations, while the services sector index remained mostly unchanged. Consequently, three out of four reports contributed to the euro's growth. In contrast, the U.S. services sector business activity index unexpectedly fell, and the consumer sentiment index came in below forecasts. As a result, nearly all reports from the day supported the euro's rise. Furthermore, the market is leaning toward an upward correction.

5M Chart of EUR/USD

On Friday, only one trading signal was generated within the 5-minute timeframe. During the European trading session, the price broke through the 1.0433 to 1.0451 range, which led to a rise towards the 1.0526 level. As a result, the euro gained nearly 100 pips for the day. A long position could have proven to be highly profitable, even though the target level was not precisely reached.

Trading Strategy for Monday:

On the hourly timeframe, the EUR/USD pair is currently in a medium-term downtrend, although there is a local upward corrective trend. A decline in the euro is still anticipated, as the fundamental and macroeconomic factors continue to favor the U.S. dollar. However, it's essential to wait for the end of the correction, which can be identified if the price consolidates below the trendline.

On Monday, market movements are expected to be much weaker compared to those on Friday. It is likely that the market will experience a correction against the current upward trend, given that the euro's rapid increase leading up to the European Central Bank (ECB) and Federal Reserve meetings seems unsustainable.

On the 5-minute timeframe, the following levels should be monitored: 1.0156, 1.0221, 1.0269-1.0277, 1.0334-1.0359, 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, and 1.0845-1.0851. On Monday, the most significant event will be a speech by Christine Lagarde. Since she has already spoken twice this week, no major changes in rhetoric are anticipated. The ECB meeting on Thursday will be crucial, and it is expected to yield the most critical statements.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.