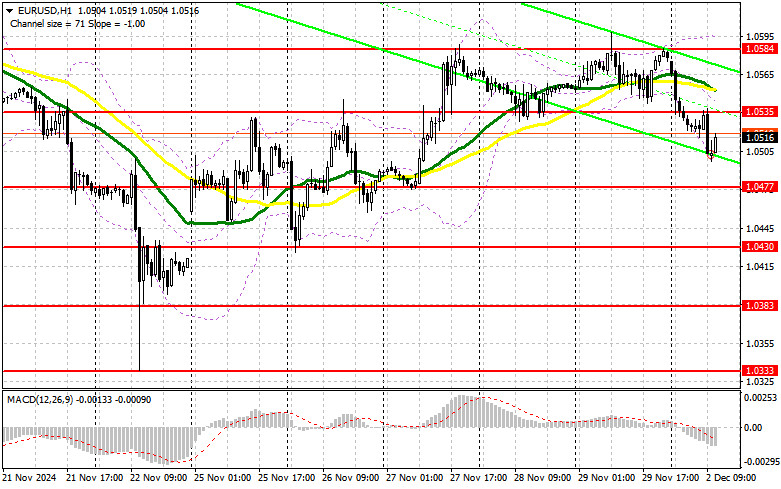

In my morning forecast, I highlighted the 1.0505 level and planned to base trading decisions on this level. Let's analyze the 5-minute chart to review what happened. A decline and the formation of a false breakout around 1.0505 provided a strong entry point for buying, resulting in a modest gain of 15 points by the time this article was written. The technical outlook for the second half of the day has been updated.

To Open Long Positions on EUR/USD

Weak data from Germany's Manufacturing PMI, noted during the Asian session, has renewed pressure on the euro. However, as the overall Eurozone figures aligned with economists' expectations, the euro managed to hold above the 1.0505 level.

In the second half of the day, focus will shift to the equivalent US report. A weak ISM Manufacturing PMI could spark volatility, weakening the US dollar. Traders should also pay attention to FOMC member Christopher Waller's speech, which may provide important signals for market movements.

If the pair continues to decline, I plan to act near the 1.0477 support level, formed last week. A clear false breakout there would provide a strong signal for increasing long positions, targeting a rise toward 1.0535, formed earlier today. A breakout above and subsequent retest of this range would confirm an optimal buying point, with potential targets of 1.0584 and 1.0620. The ultimate target will be 1.0653, where I intend to take profit.

If EUR/USD declines further and there is no significant trading activity or support formation around 1.0477, pressure on the euro is likely to intensify. In this case, I will consider long positions only after observing a false breakout near the 1.0430 support. Alternatively, I plan to buy immediately on a rebound from 1.0383, aiming for an intraday upward correction of 30-35 points.

To Open Short Positions on EUR/USD

In the event of an increase in EUR/USD, defending the 1.0535 resistance level will be the primary objective for sellers in the second half of the day. A false breakout at this level, similar to the scenario described earlier, would provide a valid entry point for short positions, targeting a drop to the 1.0477 support level.

A breakout below 1.0477 and subsequent consolidation below this range, followed by a retest from below, would confirm an additional selling opportunity, with a potential move toward the 1.0430 low. This would reverse the pair's upward correction and restore bearish momentum. The ultimate target will be 1.0383, where I plan to take profit.

If EUR/USD rises during the second half of the day and bears fail to act decisively around 1.0535—slightly above which the moving averages currently favor sellers—I will delay short positions until the pair tests the 1.0584 resistance. I will also sell at this level but only after observing a failed consolidation. Alternatively, I plan to sell immediately on a rebound from 1.0620, targeting a downward correction of 30-35 points.

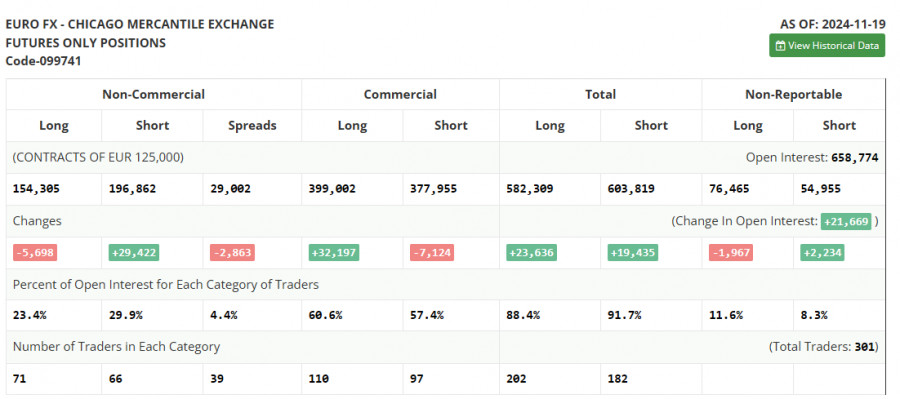

Commitments of Traders (COT) Report

The Commitments of Traders (COT) report for November 19 indicated a significant increase in short positions and a reduction in long ones. Considering the context of Donald Trump's presidency, news about tariff barriers against China, Canada, Mexico, and other countries, along with the European Central Bank's need to lower interest rates, it is unsurprising that the euro continues to lose ground against the US dollar. Even at current lows, there remains no shortage of sellers for the euro. The absence of buyers is also notable, suggesting that near-term growth for the pair is unlikely.

The COT report showed that non-commercial long positions decreased by 5,698, falling to 154,305, while non-commercial short positions increased by 29,422, reaching 196,862. As a result, the net difference between long and short positions narrowed by 2,422 contracts.

Indicator Signals

Moving Averages

Trading remains below the 30- and 50-day moving averages, keeping the pair's downward trend intact.

Note: The moving averages analyzed by the author are based on the hourly (H1) chart and differ from standard daily moving averages on the daily (D1) chart.

Bollinger Bands

In case of a decline, the lower boundary of the Bollinger Bands near 1.0500 will serve as support.

Indicator Descriptions

- Moving Average (MA): Averages prices over a specified period to smooth volatility and identify the trend. Periods used: 50 (yellow) and 30 (green).

- MACD (Moving Average Convergence/Divergence): Measures momentum and trend direction. Fast EMA: period 12; Slow EMA: period 26; SMA: period 9.

- Bollinger Bands: Identifies volatility and price levels. Period: 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who trade futures for speculative purposes.

- Non-commercial long positions: Total long positions held by non-commercial traders.

- Non-commercial short positions: Total short positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions held by non-commercial traders.