Analysis of Trades and Trading Tips for the Euro

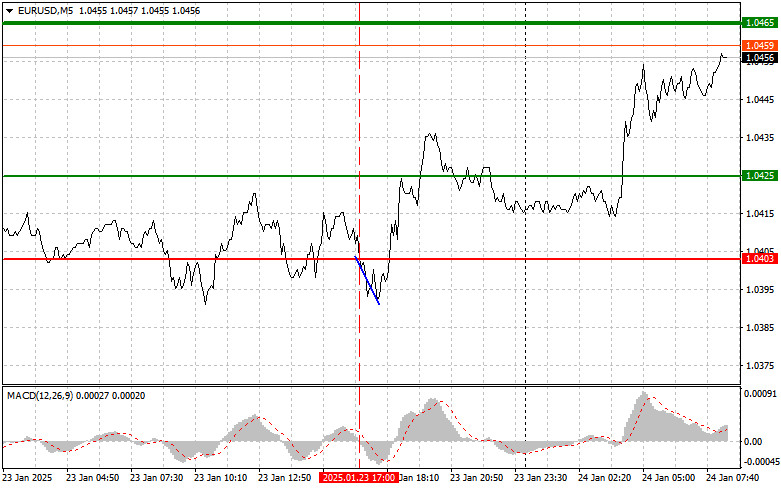

In the afternoon, the price tested 1.0403 at a time when the MACD indicator had just started to move down from the zero mark, which confirmed it as a suitable entry point into the market. Despite this, the pair did not experience a significant decline; instead, after a brief drop of 10 pips, demand for the euro returned.

The primary factor influencing this movement was Trump's speech. His threats regarding trade tariffs have raised concerns about the future of US-European trade relations, although no concrete measures have been implemented yet. In recent years, the world has witnessed multiple trade wars, and each new action from Trump's administration tends to trigger investor anxiety. European countries are also not remaining passive; some are discussing countermeasures to protect their markets from potential tariff increases. This atmosphere of uncertainty could negatively affect economic growth in both the United States and Europe. However, since these discussions are still purely speculative, the euro continues to strengthen.

Today, important data on the Eurozone's economic activity is expected to be released. Investors will closely monitor these figures, as they could significantly impact the overall state of the Eurozone. The anticipated indicators for manufacturing and services PMIs (Purchasing Managers' Index) may provide crucial insights into the region's economic recovery in the face of ongoing inflation and global uncertainty. Mixed results could indicate instability across different sectors: while manufacturing may show signs of slowing down, the services sector might reveal growth, leading to divergent investor expectations. This sentiment could support the euro while putting downward pressure on the US dollar.

However, any signs of weakness in the Eurozone economy could raise questions about the future actions of the European Central Bank (ECB). If the data falls below forecasts, there may be expectations for a more dovish stance from the ECB, which could potentially weaken the euro.

Today's strategy will primarily focus on implementing Scenario #1 and Scenario #2 outlined below.

Buy Signal

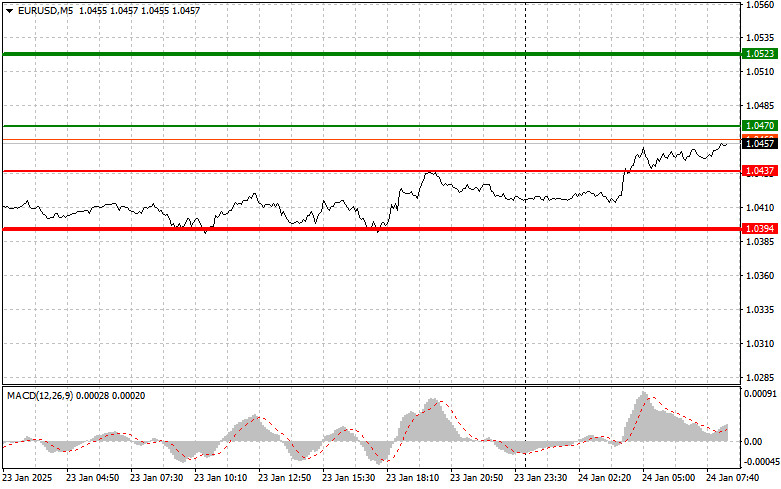

Scenario #1: Buy the euro at 1.0470 (green line on the chart) with a target of 1.0523. At 1.0523, exit the market and sell the euro in the opposite direction, expecting a 30-35 pip retracement from the entry point. Counting on euro growth in the first half of the day is only advisable if the data are highly favorable. Important: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: Consider buying the euro in case of two consecutive tests of the 1.0437 level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. Growth toward the 1.0470 and 1.0523 levels can be expected.

Sell Signal

Scenario #1: Sell the euro after reaching the 1.0437 level (red line on the chart). The target will be 1.0394, where positions should be closed. Immediate purchases in the opposite direction can be considered, expecting a 20-25 pip rebound from the level. Pressure on the pair could return at any moment. Important: Before selling, ensure the MACD indicator is below the zero mark and just beginning to decline from it.

Scenario #2: Also consider selling the euro in case of two consecutive tests of the 1.0470 level when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a market reversal downward. Declines toward the 1.0437 and 1.0394 levels can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.