EUR/USD valyuta juftligi juma kuni sezilarli darajaga ko'tarildi, bu asosan yevroning foydali makroiqtisodiy ko'rsatkichlariga bog'liq edi. Yevrozonada va Germaniyada biznes faolligi indekslari nisbatan kuchli raqamlarni namoyish qildi, garchi ular ideal darajalardan past bo'lib, Yevropa iqtisodiyoti hali barqaror emasligini va sezilarli o'sishga ega emasligini ko'rsatadi. Aksincha, AQShning biznes faolligi indekslari va iste'molchilar kayfiyati indeksi sustroq natijalarni ko'rsatdi. Bu esa dollarga qo'shma zarba berib, allaqachon haftaning boshida Donald Trumpning "drakoniya" rejalariga duch kelgan edi.

Lekin yevroning oshishi chalg'itmasligi kerak. Biznes faolligi indekslari kelajakda muhim ko'rsatkichlar bo'lsa-da, Yevropa iqtisodiyotida ijobiy o'zgarishlar belgisi aniq emas. Shu bilan birga, AQSh iqtisodiyoti alohida ko'rsatkichlarni ko'rsatishda davom etmoqda. Yevropa Markaziy Banki (ECB) yozga kelib foiz stavkasini 2% ga ko'tarishni rejalashtirgan bo'lsa, Federal zaxira (Fed) 2025-yil davomida eng ko'pi bilan ikki marta foiz stavkasini kamaytirishni kutmoqda. Shuning uchun, global iqtisodiy muhit ham, yevro ham dollar uchun o'zgarmay qolmoqda.

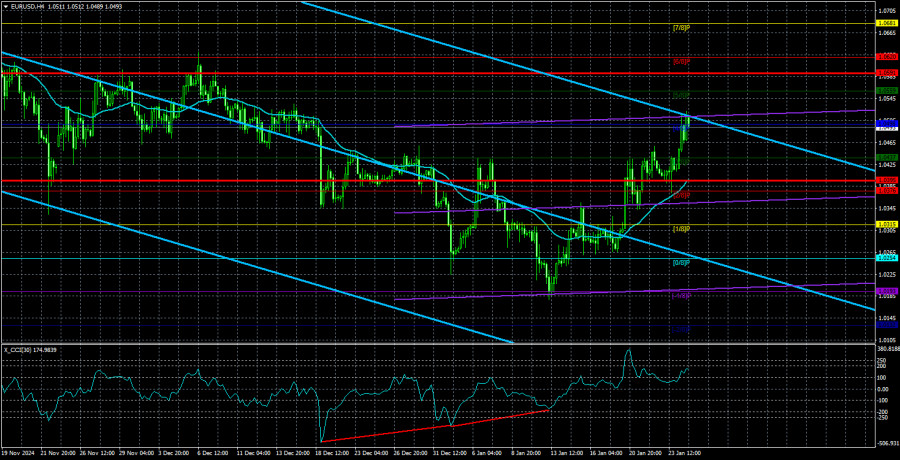

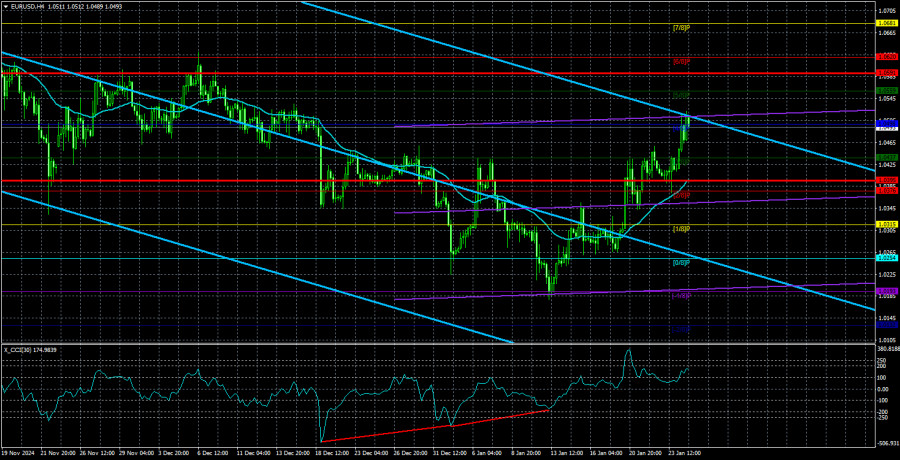

Biz bir necha vaqtdan beri kundalik vaqtlarda imkoniyatli tuzatish haqida ogohlantirgan edik va endi u boshlandi. Bozor juma kungi ma'lumotlardan foydalangan holda juftlikni yuqori ko'tarishga kiritdi. Agar biznes faolligi ma'lumotlari yo'q bo'lsa yoki yevro uchun kamroq foydali bo'lsa, ko'tarilish hali ham amalga oshirilgan bo'lar edi — agar juma kuni bo'lmasa, dushanba kuni amalga oshirilgan bo'lar edi. Ammo, CCI ko'rsatkichi allaqachon ortiqcha sotib olingan hududga yetib bordi va tez orada ayiqlar divergentsiyasini namoyish etishi mumkin.

Kelayotgan hafta muhim voqealarga boy. Dushanba kuni Christine Lagarde yevrozonada nutq so'zlaydi, shundan keyin seshanba kuni yana bir nutq keladi. Chorshanba kuni bir nechta muhim hisobotlar keladi: Germaniyaning IV chorak YAIM hisobotlari, yevrozona IV chorak YAIM hisobotlari, Yevropa Markaziy Banki yig'ilishi xulosasi va yana bir Lagarde nutqi. Juma kuni Germaniyaning chakana savdosi, inflyatsiya ko'rsatkichlari va ishsizlik miqdori kutiladi. Aniqki, yevrozonadan kelayotgan makroiqtisodiy ma'lumotlar juda ko'p va bu hali AQSh voqealarini hisobga olmagan holda!

Bu hafta texnik manzara sezilarli ravishda o'zgarishi mumkin. ECB kutilayotganicha o'zining dovish fikrini saqlashi taxmin qilinmoqda, Fed esa qattiq pozitsiyada qolishi kutilmoqda. Bu ikki omil yevroning keng va uzoq davom etadigan oshishini ehtimoldan tashqari qiladi. Hozirgi vaqtda eng muhim bo'lgan kundalik vaqtlarda narx Kijun-sen chizig'idan yuqori ko'tarilib, Senkou Span B chizig'iga yaqinlashmoqda. Bu ehtimol yuqoriga tuzatishning oxiri bo'lishi mumkin. Korreksiya dastlab kutilganidan ko'ra uzoqroq davom etishi mumkin bo'lsa-da, biz juftlikning 2025-yilning birinchi choragida 1.0640 darajasidan yuqoriga ko'tarilishini kutmayapmiz.

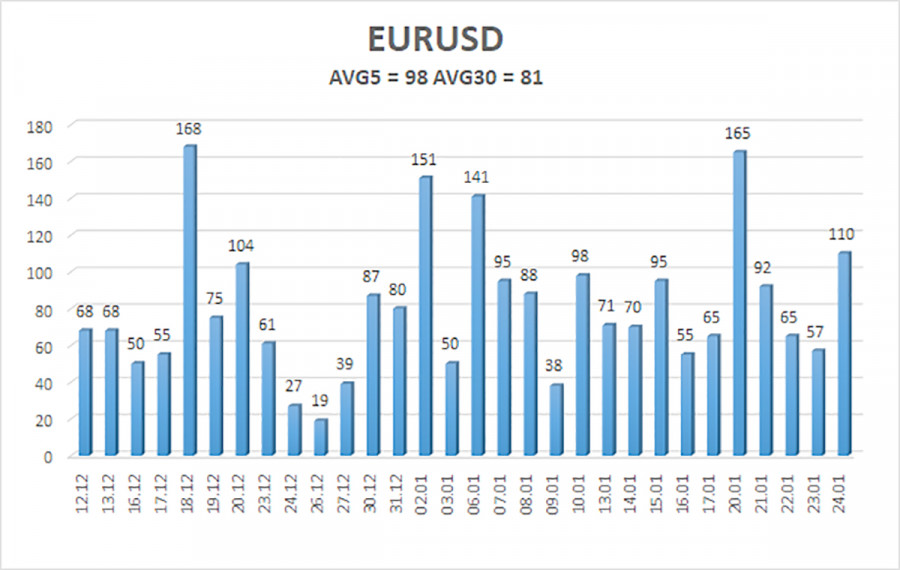

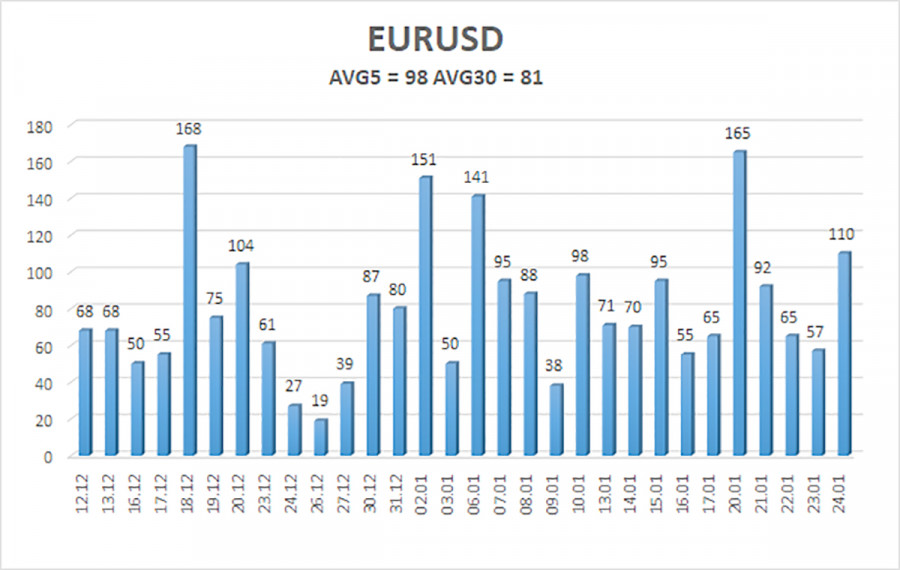

EUR/USD valyuta juftligining o'rtacha o'zgaruvchanligi 27-yanvardagi so'nggi 5-savdo kunida 98 pipga yetgan va bu yuqori toifaga kiradi. Dushanba kuni juftlikning 1.0395 dan 1.0591 gacha harakatlanishini kutmoqdamiz. Yuqori chiziqli regressiya kanali pastga yo'nalishda qolib, global tushish tendensiyasi davom etayotganini ko'rsatadi. CCI indikatori ortiqcha sotib olingan zona ichiga kirgan, bu esa pasayish tendensiyasining qaytalanishi ehtimoli borligini bildiradi. Ayiqlar divergentsiyasi shakllanishi mumkin, bu yangi pasayishni keltirib chiqarishi ehtimoli bor.

Eng yaqin qo'llab-quvvatlov darajalari:

- S1 – 1.0437

- S2 – 1.0376

- S3 – 1.0315

Eng yaqin qarshilik darajalari:

- R1 – 1.0498

- R2 – 1.0559

- R3 – 1.0620

Savdo tavsiyalar:

EUR/USD juftligi o'z yuqoriga yo'naltirilgan korreksiya harakatlarini davom ettirmoqda. So'nggi bir necha oy davomida biz o'rta muddatli yuqorida ko'tarilish kutayotganimizni aytdik va bu kamayish tendensiyasi hanuz tugamaganligiga ishonamiz. Fed o'zining pul-kredit siyosatini yumshatishni to'xtatgan, shu bilan birga ECB oʻz yumshatish tadbirlarini tezlashtirmoqda. Shu sababdan, amerika dollari texnik korrekssiyalardan tashqari, o'rta muddatli kamayish uchun fundamental sababga ega emas.

Qisqa pozitsiyalar 1.0254 va 1.0193 darajalarda maqsadlar bilan dolzarbligini saqlamoqda, lekin hozirgi korreksiyani avval tugatish kerak. Ushbu korreksiya 1.0640 darajasi yaqinida tugash imkoniyatiga ega. Agar siz faqat texnik tahlilga asoslanib savdo qilsangiz, narx harakatlanuvchi o'rtacha darajadagi ustidan qaysidir ushlab turilgan bo'lsa, 1.0559 va 1.0620 maqsadlari bilan uzun pozitsiyalarni ko'rib chiqishingiz mumkin. Biroq, bu bosqichda istalgan o'sish davomi etayotgan korreksiyaning bir qismi sifatida ko'riladi.

Illyustratsiyalarni izohlash:

Linear Regressiya Kanallari joriy tendentsiyani aniqlashga yordam beradi. Agar ikkala kanal bir yo'nalishda bo'lsa, bu kuchli tendensiyani ko'rsatadi.

O'rtacha harakatlanish chizig'i (sozlamalar: 20,0, silliq) qisqa muddatli tendensiyani belgilaydi va savdo yo'nalishini boshqaradi.

Murrey darajalari harakatlar va korreksiyalar uchun maqsad darajalari sifatida xizmat qiladi.

O'zgaruvchanlik darajalari (qizil chiziqlar) juftlikning kelgusi 24 soat ichida ehtimoliy narx diapazonini joriy o'zgaruvchanlik o'qishlariga asoslangan holda ko'rsatadi.

CCI Indikatori: Agar u ortiqcha sotilgan hududga (-250 dan pastga) yoki ortiqcha sotib olingan hududga (+250 dan yuqoriga) kirsagina, qarama-qarshi yo'nalishda yaqinlashayotgan tendensiya o'zgarishini bildiradi.