The GBP/USD currency pair experienced a significant growth on Friday. While the PMI indices from the UK and the US played a role in this movement, one must question whether the 150-pip rise is truly warranted based on these reports. The Manufacturing PMI climbed to 48.2, which remains below the critical threshold of 50.0—any value below this indicates a contraction. The Services PMI only slightly improved from 51.1 to 51.2. At first glance, the data might seem positive, but a closer examination reveals that it likely couldn't have caused such a significant shift, especially one that is seldom seen even after central bank meetings.

It's important to note that the market seems to be leaning towards buying the pound primarily due to a long-standing correction; the pound has been in decline for a long time. This might not just be about purchasing sterling, but rather about selling the dollar, possibly influenced by Donald Trump's forthcoming decisions. Alternatively, it could simply be that traders are taking profits from short positions they have held for the past 3.5 months. Regardless of the reason, we do not see a strong long-term justification for sustained growth in the pound. The 16-year downtrend remains intact, and the 4-month downtrend has not been broken. On the daily chart, the recent increase in the pound is minor compared to its previous decline. Therefore, while the pound may continue to rise for another week or two, this does not negate either the larger or smaller downtrend.

Further growth for the pound is likely to be challenging. This week, the Federal Reserve will hold its first meeting of 2025, and it's almost guaranteed that interest rates will remain unchanged. Meanwhile, the Bank of England is expected to cut rates next week, with additional cuts likely to follow later this year. There are no significant data releases scheduled in the UK this week, but that may not be necessary—sufficient information has already been gathered about the state of the British economy, and there hasn't been much positive news.

In contrast, the US will have a far busier week. On Tuesday, a crucial report on durable goods orders will be released. On Wednesday, the Federal Reserve meeting will conclude. On Thursday, another important report will be published. On Friday, the Personal Consumption Expenditures (PCE) Price Index will be issued. The GDP for the fourth quarter is expected to show stable and strong results, and the Fed is unlikely to suggest any rate cuts in the near future. It's also worth noting that Trump plans to pressure Powell to cut rates, similar to what he did four years ago. He insisted persistently and frequently summoned Powell for discussions, but ultimately, it did not lead to any changes. From our perspective, there's no reason to fear the Fed succumbing to Trump's demands. Trump has his own responsibilities, and the Fed has its own. If Trump wishes to pursue his "Napoleonic plans," the consequences of those plans will rest squarely on his shoulders.

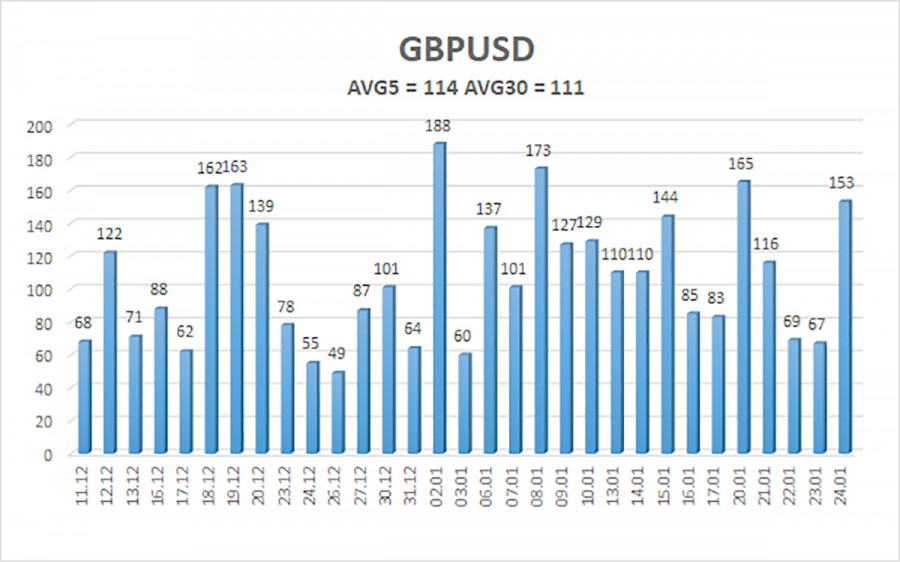

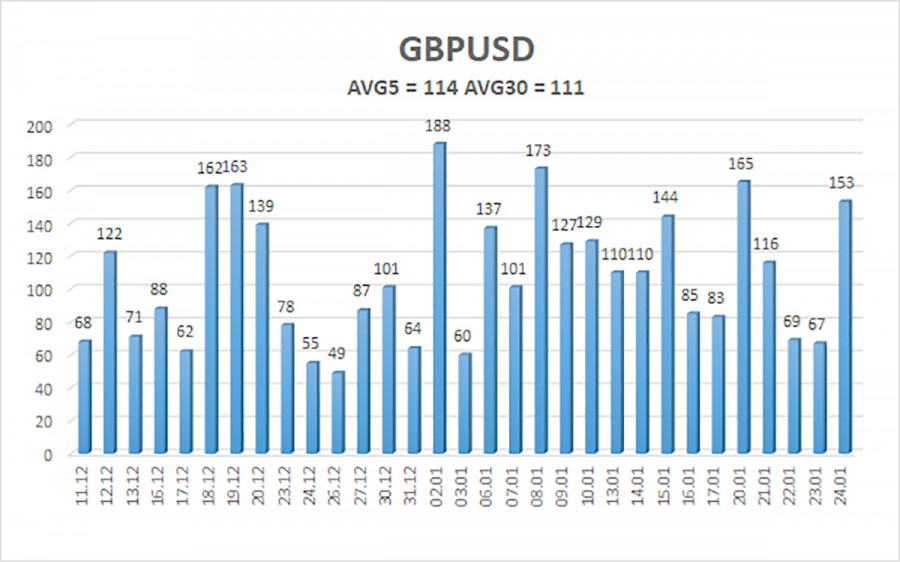

The average volatility of the GBP/USD pair over the last five trading days is 114 pips, considered "high" for this pair. Therefore, on Monday, January 27, we expect the pair to move within a range limited by the levels 1.2364 and 1.2592. The upper linear regression channel is directed downward, signaling a bearish trend. The CCI indicator recently entered the overbought zone and may form a bearish divergence, suggesting a potential downward trend resumption.

Nearest Support Levels:

- S1 – 1.2451

- S2 – 1.2390

- S3 – 1.2329

Nearest Resistance Levels:

- R1 – 1.2512

- R2 – 1.2573

- R3 – 1.2634

Trading Recommendations:

The GBP/USD pair remains in a downward trend. Long positions are still not recommended, as we believe all factors driving the British pound's growth have already been fully priced into the market, and no new bullish catalysts are present.

If you trade based on pure technical analysis, long positions may be considered with targets at 1.2573 and 1.2592, provided the price stabilizes above the moving average line. However, short positions remain much more relevant, with targets at 1.2207 and 1.2146. The price must consolidate below the moving average for these to become viable.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.